Mar 21, 2024

Traders Earned 20% Using Ghost Bonds in Argentina’s Record Swap

, Bloomberg News

(Bloomberg) -- A small group of savvy investors made 20% gains in Argentina’s record $50 billion local debt swap despite not actually handing over eligible bonds.

The government received 61.6 billion pesos ($72 million) in cash from participants who promised to deliver the notes but later reneged, realizing that paying in cash would be cheaper than giving up the bonds the government was trying to swap.

While only a fraction of the total amount swapped, it’s an unprecedented level of default in official debt auction. It was prompted by both a loophole in the government’s issuance terms and by the central bank’s surprise rate cut on the first night of the swap.

The Economy Ministry, which outlined the reneged trades in a Friday statement, didn’t respond to a request for further comment. It plans to auction new peso debt Thursday for the first time since its swap.

The investors that reneged realized that paying in cash would be cheaper than giving up the bonds the government was trying to swap — generating criticism from traders on social media.

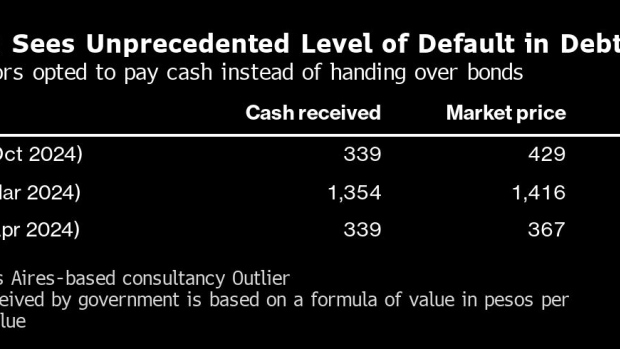

According to the auction terms, the government said it would debit the bond value in pesos from an investor’s account should it default on delivery. But some of the values listed were lower than the market price of the bonds. For example, the government bought inflation-linked bonds maturing in 2024 at 3.39 pesos, while in the secondary market they were offered at 4.29 pesos, or 20.1% more.

What’s more, sovereign bond prices got a boost halfway through the government’s auction when the central bank reduced its benchmark interest rate by 20 percentage points.

“After the rate move, some participants saw that it was in their interest to default and deliver the pesos instead of the bonds,” Juan Manuel Truffa, a partner at local consultancy Outlier, said in an interview.

A spokeswoman for the national securities regulator, CNV, said its rules allow an issuer to receive new money in a debt swap as long as it’s included in the issuance conditions.

In total, the government swapped 42.6 trillion pesos worth of local bonds due in 2024 for securities maturing between next year and 2028, giving it more breathing room to shore up public finances and stabilize Argentina’s crisis-prone economy.

Demand for the swap was guaranteed, since more than 70% of Treasury bonds are held by public institutions including the central bank, social security agency Anses and Banco Nacion, according to estimates by consulting firm 1816 Economia & Estrategia. Only 17.5% of local private sector debt holders participated in the auction.

©2024 Bloomberg L.P.