Dec 1, 2022

Traders Start Taking Notice as China ETF Rebound Gets Extreme

, Bloomberg News

(Bloomberg) -- The huge rally in China exchange-traded funds looks like it’s finally winning over American investors.

Double-digit surges posted by a slew of China-focused funds had been met with muted interest in the early stages of the rally, as investors waited to see if the Asian nation would respond to domestic pressure to ease up on crippling Covid measures.

But inflows have mounted in the past weeks, and bullish options activity on several of the ETFs is surging.

The $7.3 billion iShares MSCI China ETF (ticker MCHI) has risen roughly 32% for the month of November and saw around $567 million of inflows. MCHI tracks the MSCI China Index, which measures the performance of major Chinese companies.

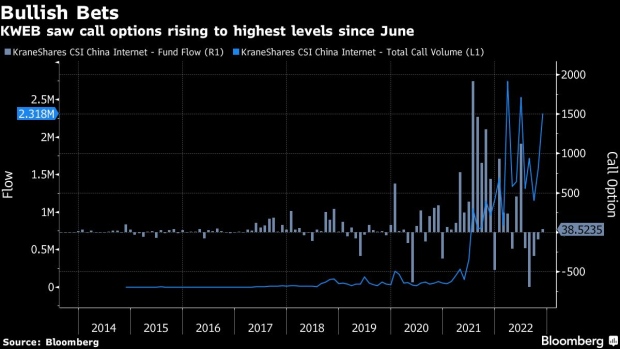

The $5.8 billion KraneShares CSI China Internet Fund (KWEB) has also climbed 48% in the past month with call volume rising to the highest level since June. However, KWEB, which tracks an index that invests in publicly traded China-based companies whose primary business is the internet, has not seen significant inflows.

China has been making slow but visible progress in loosening its stringent Covid restrictions, sparking a rally in stocks related to the nation’s economy. Beijing on Thursday said it will allow some virus-infected people to isolate at home, a landmark shift that reflects the pressure officials are under from public opposition to Covid Zero.

Read more: Beijing Eases Covid Curbs, Letting Some Patients Isolate at Home

“The ‘Real Pivot’ in the market is China on Covid, not the Federal Reserve,” said Dave Lutz, head of ETFs at JonesTrading. “Feels like KWEB was the primary vehicle guys were using to short China and it’s a decent cover bid along with real buying now. So, while there have been no net flows, under the surface there is a decent regime change.”

Other funds including the $5 billion iShares China Large-Cap ETF (FXI) and the $2 billion Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) have edged higher by 34% and 17%, respectively, in November, with FXI seeing a one-day inflow of $105 million on Nov. 30, the most since March.

“Investors are optimistic that China is opening up and will return to economic growth in 2023 at levels seen in the past and these targeted Chinese ETFs offer a good opportunity to get in ahead of the economic improvement,” Todd Rosenbluth, head of research at ETF data provider and research consultant VettaFi, said in an interview.

Read more: Chinese Stock Rally Cools as Investors See Bumpy Reopening

Investors, however, are slowly realizing that the road to a full re-opening -- which Goldman Sachs Group sees will happen around the middle of next year -- may be patchy.

This may be why the $158 million Direxion Daily FTSE China Bear 3X Shares (YANG), which aims to deliver three-times the inverse of the performance of the FTSE China 50 Index before fees and expenses, is seeing some inflows as well as call options, according to Rosenbluth.

“Because we have seen such a bounce in recovery in the Chinese markets, some investors are taking the other side and believing its short lived,” he said. “I think sentiment towards China remains mixed.”

--With assistance from Sam Potter.

©2022 Bloomberg L.P.