Jul 5, 2022

TSX pares losses even as oil falls below US$100 per barrel mark

, BNN Bloomberg

The U.S. stock market is still in the middle of 25 year bull market: Brian Belski

Canada’s main stock index pared back some of its losses on Tuesday to close 194.70 points lower at 18,834.16.

Earlier in the trading session, the index fell nearly 400 points as energy stocks dragged the broader market.

Athabasca Oil Corp., Precision Drilling Corp. and Paramount Resources Ltd. were some of the biggest decliners on the TSX on Tuesday.

The trading day tumble comes as stock markets in North America continue to be volatile amid fears of a recession.

“We have lots of cash. In other words, we don't have a lot of positions in our fund right now and the main reason is we expect a recession. A lot of people seem to be talking about it, but I'm not sure everybody agrees to it,” Jean-François Tardif, founder and portfolio manager at Timelo Investment Management, said in an interview Tuesday.

Tardif said his organization is being careful in the short term as the U.S. Federal Reserve continues its campaign of quantitative tightening.

“If the inflation on July 13 in the U.S. -- that's the important key here -- if it's higher than expected, probably [we are] going to get another dump of stocks and if the number was way better than expected, that meaning lower, you could have a run. So it will be a little bit of a potentially risky or volatile time next week, but that's key data to follow,” he said.

Markets in New York also ended off their lows of the day. The S&P 500 barely ended the day in positive territory – up 6.06 points at 3,831.39. The Dow closed 129.44 points lower at 30,967.82 and the Nasdaq posted a 194.40-point gain to end at 11,322.24.

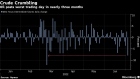

American benchmark West Texas Intermediate (WTI) crude sank by US$8.93 to settle at US$99.50 per barrel, trading below the $100-level for the first time in a month.

A report by Citigroup Inc. Analysts Francesco Martoccia and Ed Morse warned oil prices could slide further if we enter a recession.

“In a recession scenario, we would see oil prices falling to $65 per barrel by year end and potentially to $45 per barrel by end-2023, absent intervention by OPEC+ and a decline in short-cycle oil investment,” the analysts said in a note to clients on Tuesday.

However Helima Croft, managing director and global head of commodity strategy at RBC Capital Markets, said she sees oil continuing to move higher in the long term based on the commodity’s fundamental backdrop.

“We do see scenarios where recession-driven selloffs could take prices lower,” Croft said in an interview on Tuesday.

“But again, when we get that fundamental picture, as we look at the next year as well, we think this is going to be a market that we're talking about WTI and Brent above US$100 per barrel.”

Croft added that her real concern right now is the risk of Russia cutting off shipments of natural gas and oil to Europe.

“We may be looking at industrial curtailment. We are basically facing a real winter of discontent when it comes with a gas situation in Europe. North American [liquefied natural gas] is not able to make up the shortfall right now,” she said.

Natural gas prices have surged 700 per cent in Europe since the beginning of 2021, exacerbated by the war in Ukraine and Russia cutting back on pipeline deliveries to Europe.

Traders have flocked to the U.S. dollar as a safe haven asset, pressuring global currencies, including the Canadian dollar. The loonie traded a full cent lower against the greenback to end at 76.71 cents U.S.