Aug 13, 2020

TSX Venture comes roaring back, surges 114 per cent from all-time lows

, BNN Bloomberg

Venture exchange roars back

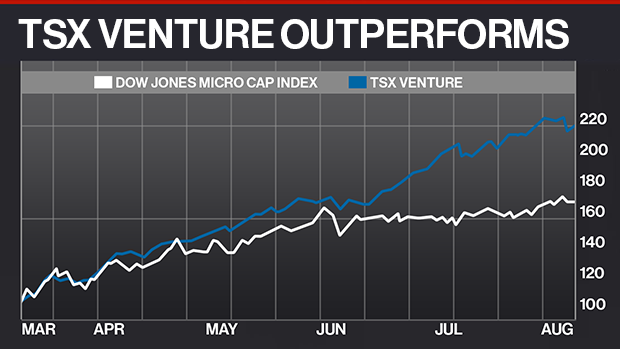

The recent run in junior mining stocks has sent the S&P/TSX Venture Composite Index surging, with Canadian small caps easily outpacing gains made by major indices on both sides of the border.

The Venture Composite Index has gained 114 per cent after hitting an all-time low on March 18, easily outpacing the 48 per cent gain booked by its big-brother TSX since its year-to-date trough on March 23.

The TSX Venture counts some of Canada’s most speculative stocks among its members, including many pre-profitability and at times, pre-revenue firms. The index has seen an influx of cannabis companies join its ranks as Canada legalized recreation pot, but It remains dominated by junior miners, with materials accounting for a full 62.5 per cent of the index.

Sentiment around gold stocks has improved markedly during bullion’s record-breaking rise over the course of 2020, helping drive trading activity on the venture to levels not seen in years.

The small cap index’s returns even dwarfed the 65 per cent gains booked by the Dow Jones Micro Cap Index during the same period, easily topping the performance of its closest peer south of the border.

In all, 368 of the Venture’s 388 constituents are in positive territory since the March lows. BNN Bloomberg takes a look at some of the notable performances:

Gainers:

Pyrogenesis Canada Inc: +2,675 per cent

MedMira Inc.: +1,875 per cent

Teuton Resources: +1,230 per cent

Montreal-based Pyrogenesis was the top performer on the venture exchange, gaining nearly 2,700 per cent in less than five months. The company specialized in plasma-fired systems, including industrial-grade incinerators and plasma torches used in the oil and gas industry to cut through thick metal sheets.

Shares of medical-testing company MedMira surges through the early months of the pandemic, rising almost 1,900 per cent. The company, which develops rapid tests for HIV and syphilis, among other diseases, turned its attention to COVID-19 in the wake of the outbreak. Shares of the company surged 214 per cent in a single session after MedMira announced it applied to the U.S. Food and Drug Administration for an Emergency Use authorization to begin selling its COVID test.

In spite of the TSX Venture’s resource-heavy reputation, junior gold exploration company Teuton Resources was the only materials stock to crack the top three. The company, which is focused on exploration in Northern British Columbia’s Golden Triangle district, got a boost after it attracted the interest of long-time gold investor Eric Sprott. Sprott increased his stake in the company earlier in the summer, buying an additional $9 million stake through a private placement. Sprott now owns about 20.5 per cent of the firm, according to data compiled by Bloomberg.

Losers:

Perisson Petroleum Corp: -40 per cent

Mosaic Capital Corp.: -39 per cent

Decisive Dividend Corp: -39 per cent

Perisson Petroleum booked the largest percentage loss among TSX Venture listings from trough to peak, falling 40 per cent. The oil-and-gas exploration and production services firm’s shares are thinly traded, often going days without a single trade. The company holds oil and gas producing properties near Wainwright, Alta.

Shares of Mosaic Capital and Decisive Dividend booked nearly identical 39 per cent losses from the lows, as the COVID chill fell over Canadian small business activity. The firms, which both invest in small Canadian businesses in a bid to generate stable dividends for shareholders, were both forced to suspend their payouts as the slowdown activity weighed on revenue on their portfolio companies.

VOTE