Feb 2, 2020

U.S. Stock Futures Rebound After China Stimulus Calms Virus Fear

, Bloomberg News

(Bloomberg) -- U.S. stock futures rebounded as investors took solace in emergency stimulus by China’s government, speculating it would calm two weeks of volatility in global markets spurred by the coronavirus outbreak.

March contacts on the S&P 500 rose 0.3%, while futures on the Nasdaq 100 added 0.2% as of 6:01 p.m. in New York. The moves come as Chinese markets prepare to reopen after a holiday break that saw losses spiral in equities and commodities, and Treasury yields fall to five-month lows.

Over the weekend, China’s central bank said it will supply a net $21.7 billion to money markets while advising banks to lend more in an effort to limit the market influence of coronavirus, which has killed more than 300 people in the country and infected over 14,000.

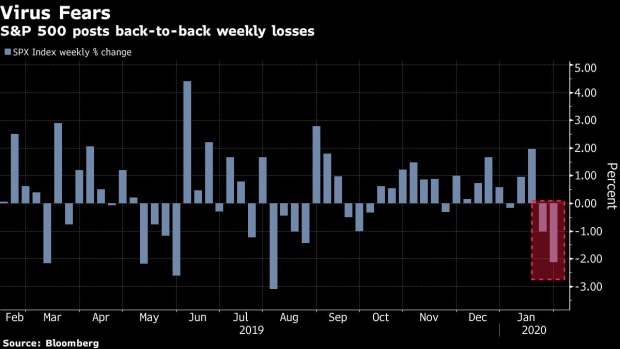

Anxiety the outbreak will lay low an already fragile global economy has shattered four months of tranquility in U.S. stocks, doubling and tripling the size of daily swings in the S&P 500 and drowning out a solid earnings season. Stellar results from Apple Inc., and Amazon.com Inc. last week could do nothing to cushion markets and equities ended with back-to-back weekly losses for the first time since October.

“You don’t know how to size what the outbreak’s going to be. That’s really scared people,” Steve Chiavarone, a portfolio manager with Federated Investors, said by phone Sunday. “I don’t think the market can get calm about the coronavirus until we know we’re out of that peak-outbreak period, and we just don’t know that yet.”

Complicating the calculation for stateside traders is China’s vast sway in the global economy. While U.S. companies are in the process of reporting particularly strong forecasts for 2020 earnings, should Asia’s economic engine sputter those projections could come asunder. Angst over profit growth is already running high after 2019 saw virtually none in the S&P 500.

Concerned about the virus and also presidential politics, with the Iowa Caucuses set for Monday, investors have been using the options market to hedge. The Cboe put-to-call ratio for stocks, which tracks volume in bearish versus bullish bets, has been going up for eight straight days, the longest streak since September. The index’s 10-day moving average sits at 0.59, the highest level in almost seven weeks.

“While the extent and severity of the virus is not yet known and we do not have a view on its likely spread or duration, the closures already announced by the Chinese government, including factory shutdowns and stoppages in freight rail traffic, are likely to have a first order effect on the U.S. economy,” UBS’s Robert Martin wrote in a note.

Past epidemics provide imperfect blueprints for the impact on markets. In 2003, when SARS began to infect thousands across the Asia Pacific region, the MSCI Pacific ex Japan Index dropped 13% at the start of the year, only to end higher by more than 40%. In the U.S. that year, the S&P 500 dropped as much as 4.6% from June to August, before climbing to finish the year up 26%.

Every market is different. While global stocks were in the process of bottoming from the dot-com crash in 2003, right now the S&P 500 is approaching the 12th year of a bull market that is by some measures the longest ever. Valuations, particularly for the giant tech stocks that have led the advance, have rarely been higher than now and the Federal Reserve has already cut interest rates three times since July.

“Stocks were due to consolidate after last year and seem to be doing that in a very normal way,” said Jason Browne, president of Alexis Investment Partners. “I am not expecting a much deeper decline but would have been surprised if we didn’t see this volatility continue for a few more weeks.”

--With assistance from Sarah Ponczek.

To contact the reporters on this story: Elena Popina in Hong Kong at epopina@bloomberg.net;Vildana Hajric in New York at vhajric1@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Chris Nagi

©2020 Bloomberg L.P.