Nov 9, 2022

U.S. stocks sink on crypto, earnings woes ahead of CPI

, Bloomberg News

BNN Bloomberg's closing bell update: Nov. 9, 2022

U.S. stocks declined as disappointing earnings and renewed selling in cryptocurrencies weighed on risk sentiment ahead of a key inflation report. The dollar gained for the first time in four days.

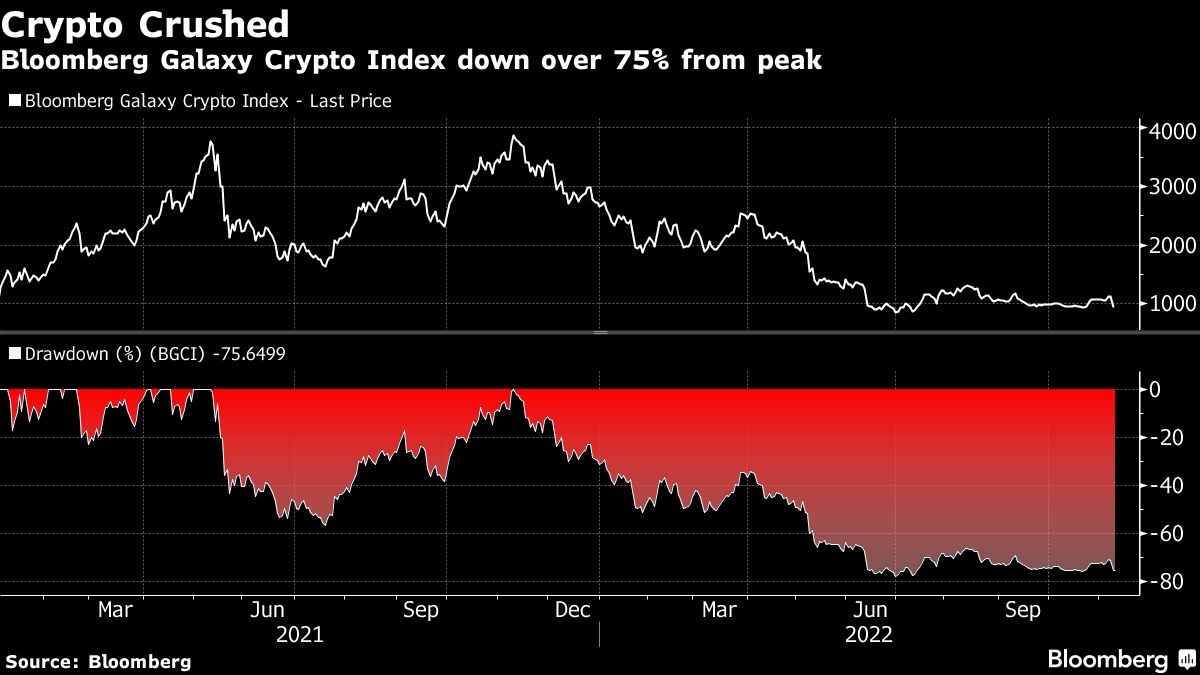

The S&P 500 put paid to a three-day rally, with all 11 major industry groups in the red. The tech-heavy Nasdaq 100 dropped the most among benchmarks, closing down 2.4 per cent. Walt Disney Co. and News Corp. tumbled after posting results that fell short of expectations, while Bitcoin dropped below US$17,000 for the first time since 2020 amid a deepening selloff in cryptocurrencies.

After midterm elections failed to deliver a Republican sweep, attention shifted toward the closely watched inflation report due Thursday for clues on the path of Federal Reserve policy tightening.

“Elections matter, but other factors matter more for markets and the economy,” Keith Lerner, co-chief investment officer at Truist Wealth, said in a note. “The path of inflation, interest rates, monetary policy, the economy, and earnings will continue to exert the greatest influence on markets over the next year.”

U.S. inflation probably moderated slightly in October, with the consumer price index and the core measure that excludes food and energy both seen cooling on an annual basis. But with the overall annual inflation rate exceeding forecasts in six of the prior seven months, another upside surprise could dash hopes of a Fed downshift after four jumbo rate hikes.

On the election front, investors had eyed prospects of a Republican comeback in Congress, with GOP taking control of both the House of Representatives and Senate. But U.S. voters delivered a mixed verdict, with Republicans heading for control of the House by smaller margins than forecast and the race for Senate still wide open.

More commentary

- “Portfolios will assess and adjust their risk now that the ‘uncertainty’ of the U.S. mid-term elections fading,” wrote Craig Johnson, chief market technician at Piper Sandler. “Soon enough, their focus will shift back to this week’s corporate earnings results and the upcoming October CPI data.”

- “The market is still going to fixate on inflation, which is going to stay high and sticky at least over the next couple of quarters,” Luke Barrs, global head of fundamental equity client portfolio management at Goldman Sachs Asset Management, said on Bloomberg TV.

Key events this week:

- U.S. CPI, U.S. initial jobless claims, Thursday

- Fed officials Lorie Logan, Esther George, Loretta Mester speak at events, Thursday

- US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 2.1 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 2.4 per cent

- The Dow Jones Industrial Average fell 1.9 per cent

- The MSCI World index fell 1.6 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.6 per cent

- The euro fell 0.6 per cent to US$1.0011

- The British pound fell 1.7 per cent to US$1.1349

- The Japanese yen fell 0.6 per cent to 146.52 per dollar

Cryptocurrencies

- Bitcoin fell 13 per cent to US$16,216.08

- Ether fell 13 per cent to US$1,163.86

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.11 per cent

- Germany’s 10-year yield declined 11 basis points to 2.17 per cent

- Britain’s 10-year yield declined 10 basis points to 3.46 per cent

Commodities

- West Texas Intermediate crude fell 3.7 per cent to US$85.58 a barrel

- Gold futures fell 0.5 per cent to US$1,707.80 an ounce