Jun 24, 2019

U.S. Supreme Court Rejects Argentina, YPF on Shareholder Suit

, Bloomberg News

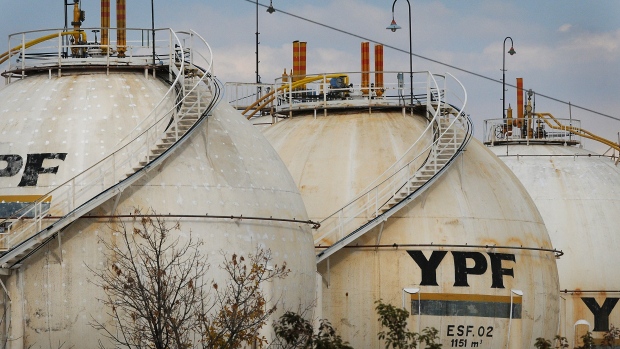

(Bloomberg) -- The U.S. Supreme Court rejected appeals from Argentina and its state-run oil producer YPF SA, clearing the way for a shareholder lawsuit to go forward over the 2012 nationalization of the company.

The rebuff is a victory for Burford Capital Ltd., which is financing Petersen Energia Inversora S.A.U.’s suit. Petersen, which held a 25% stake in YPF at the time of the nationalization, says that company breached a contractual promise in its bylaws to make a tender offer to shareholders.

Argentina and YPF argued unsuccessfully to the Supreme Court that the suit, filed in federal court in Manhattan, was barred by a U.S. sovereign immunity law. The Trump administration in May urged the Supreme Court not to take up the appeals.

The high court action opens Argentina to the possibility of having to pay even more money to creditors. The nation was locked in a debt battle for years with hedge funds led by billionaire Paul Singer, though President Mauricio Macri paid up three years ago in order to be able to tap global bond markets.

Burford said last July it had sold a portion of its Petersen stake at a price that implied an $800 million value for the original investment. Burford said it retained 71% of its original stake.

Argentina took over control of YPF by expropriating 51% of its shares from Spain’s Repsol YPF S.A., which at the time was the majority shareholder. Petersen says that caused the value of its shares to drop precipitously.

The cases are YPF v. Petersen, 18-575, and Argentine Republic v. Petersen, 18-581.

To contact the reporters on this story: Greg Stohr in Washington at gstohr@bloomberg.net;Jonathan Gilbert in Buenos Aires at jgilbert63@bloomberg.net

To contact the editors responsible for this story: Joe Sobczyk at jsobczyk@bloomberg.net, Laurie Asséo

©2019 Bloomberg L.P.