Aug 2, 2022

Uber surges most since 2020 as demand eases worries on inflation

, Bloomberg News

Uber jumps after earnings beat

Uber Technologies Inc. soared the most since 2020, buoyed by revenue that beat analysts’ estimates as customers kept hailing rides and ordering takeout food in the face of quickening US inflation.

“The business is really hitting on all cylinders,” Chief Executive Officer Dara Khosrowshahi said Tuesday in an interview on Bloomberg Television. He pointed to Uber’s record gross bookings and revenue, which more than doubled to US$8.1 billion in the second quarter, and said the dual mission in carrying people and making deliveries would set it apart from peers in the event of an economic downturn.

Khosrowshahi’s optimistic tone stood out in a turbulent time for technology companies, as inflation stokes fears of a pullback in consumer spending for services like food-delivery and rides. Uber Eats revenue grew 25 per cent from a year ago and Khosrowshahi said a key focus for the company the remainder of this year will be increasing profitability in the delivery segment.

“Both the US and international are growing at a rate of 40 plus percent which is super healthy,” Khosrowshahi said. “We are big believers in delivery and the focus here is, really, profitability.”

Uber shares gained 19 per cent in New York, closing at US$29.25. That brings the stock’s losses for the year to 30 per cent.

The number of new drivers on the platform increased during the second quarter and wait times and surge pricing will improve further as driver supply comes back into balance with customer demand, Khosrowshahi said.

In the three months ended June 30, Uber reported gross bookings, which encompass ride hailing, food delivery and freight, increased 33 per cent to an all-time high of US$29.1 billion. Adjusted earnings before interest, tax, depreciation and amortization rose US$873 million to US$364 million, far exceeding expectations.

Uber reported 122 million people used the platform monthly, surpassing the 120.5 million analysts expected. Its global driver and courier base grew 31 per cent from last year to almost 5 million.

Khosrowshahi said in May the company is “recession resistant,” but it has still taken steps to keep costs in check, by treating “hiring as a privilege.” Lyft also said it plans to significantly slow hiring and cut expenses.

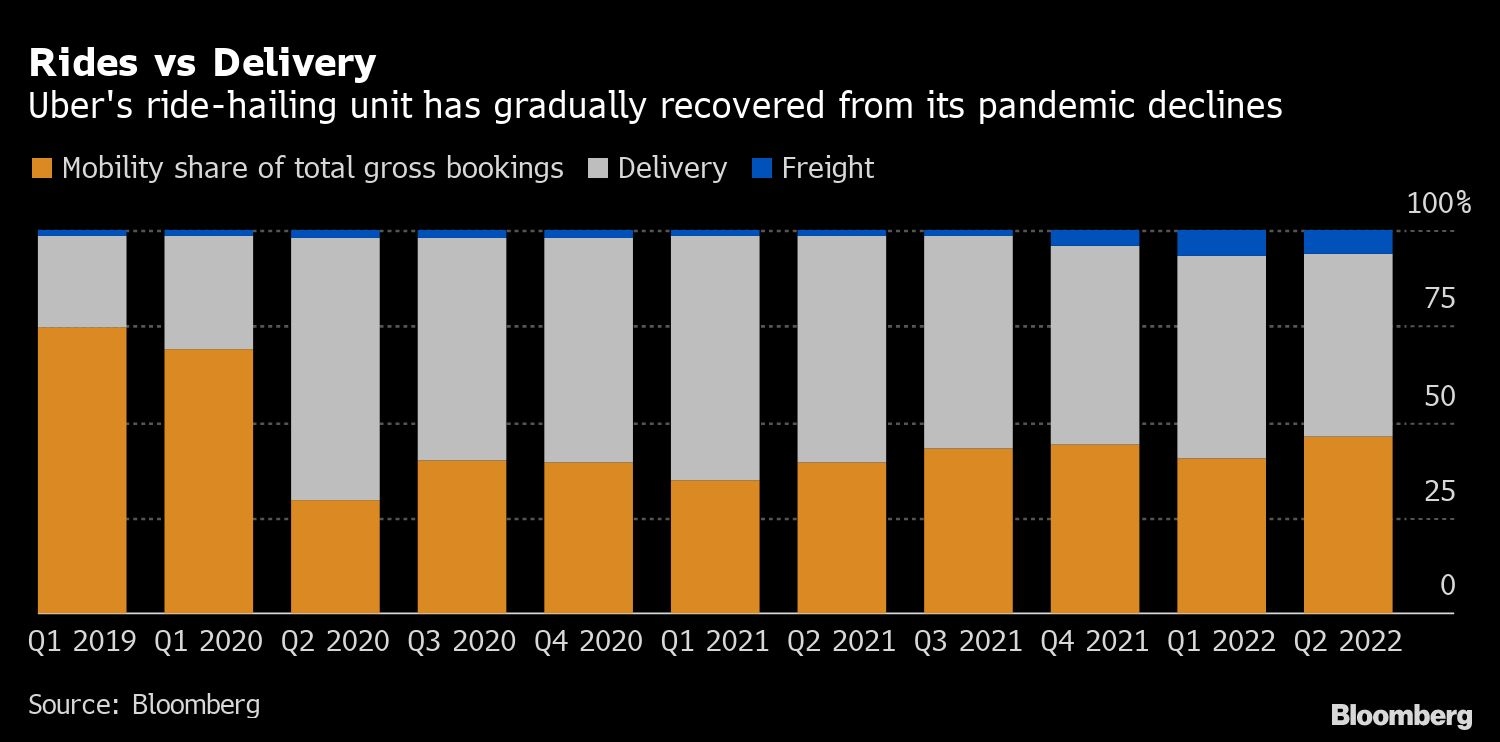

A key advantage against rival Lyft is Uber’s food-delivery business Uber Eats, which boomed during the pandemic just as ride-hailing demand cratered. Uber’s delivery arm, including restaurant, grocery items and alcohol, saw bookings increase 7 per cent from a year ago to US$13.9 billion. Khosrowshahi cautioned that delivery bookings are expected to be “roughly flat” in the current period compared to the second quarter. Still, Uber is making more money from delivery than ever, in part because of contributions from its higher-margin advertising business.

Uber projected gross bookings of US$29 billion to US$30 billion in the third quarter and adjusted earnings before interest, tax, depreciation and amortization of US$440 million to US$470 million. That beat expectations of US$391.6 million.

In the second quarter, Uber recorded a net loss of US$2.6 billion, or US$1.33 a share, due to unrealized losses from stakes in Grab Holdings Ltd., Aurora Innovation Inc and Zomato Ltd.