Apr 9, 2023

Ueda Kicks Off BOJ Governorship in First Transition in a Decade

, Bloomberg News

(Bloomberg) -- Kazuo Ueda took over the reins at the Bank of Japan, replacing Haruhiko Kuroda, whose decade-long aggressive easing efforts made the central bank capable of jolting global financial markets with just a small tweak to its policy.

Ueda began his five-year term Sunday, inheriting a monetary stimulus program from Kuroda after $11.7 trillion was spent in the pursuit of the central bank’s stable 2% inflation target. Now BOJ watchers largely see Ueda as tasked with achieving a soft landing for the massive program rather than expanding it further, as signs of its side effects pile up.

Read more: Kuroda Departs Leaving $11.7 Trillion Experiment to Successor

The new governor will be holding his inaugural press conference at around 7:15pm later Monday, together with his deputy governors Shinichi Uchida and Ryozo Himino.

Ueda has the chance to drop hints of any intention to shift policy at his first briefing as governor, after an anticipated meeting with Prime Minister Fumio Kishida. During his confirmation process, Ueda has said monetary easing needs to be in place, bringing greater market focus to if and when he will adjust the bank’s yield curve control program to make the policy framework less harmful.

While Ueda could still leave everything unchanged for a while, in a sign of traders guarding themselves against potential YCC adjustments, Japan’s 10-year bond yields have climbed back up. That’s in sharp contrast to other major economies, where there’s been an easing of upward yield pressures following the banking crises in the US and Europe.

As the first academic to head the 140-year old institution, Ueda has so far struck a neutral tone on monetary policy, unlike Kuroda who began his term in 2013 with a clear pledge to bolster stimulus.

In his first parliamentary hearings for confirmation in February, Ueda said his biggest responsibility is to make the right call at the right time for policy as needed, whether it’s a change toward normalization or continuing stimulus.

“If I’m appointed BOJ governor, my mission isn’t to come up with some kind of magical, special monetary policy,” Ueda said on Feb. 24.

The 71-year old is scheduled to hold his first policy meeting between April 27-28. Mainly due to increasing signs of deterioration in financial market functioning, most BOJ watchers expect some kind of policy tightening by June, according to a Bloomberg survey published early last month.

Those who have known Ueda well for decades — including Kuroda — say that Ueda is a great choice for governor, with his pedigreed academic background and practical experience as a former BOJ board member around the early 2000s. Some 94% of economists said Ueda is a good pick, or more or less a good pick, in a recent Bloomberg poll.

Ueda earned his doctorate from the Massachusetts Institute of Technology after graduating from the University of Tokyo, and has been dubbed Japan’s Ben Bernanke by former Treasury Secretary Larry Summers. Ueda is another on the list of central bank chiefs who are graduates of Stanley Fischer’s school of economics, adding his name alongside Bernanke and Mario Draghi.

At the age of 46, Ueda became a BOJ board member in 1998, and served in the position for seven years. During his term, Japan was struggling with the fallout of its own financial crisis and deflation. Ueda was “the pillar that ensured our theory wasn’t just pie in the sky,” then Governor Toshihiko Fukui said at Ueda’s farewell meeting.

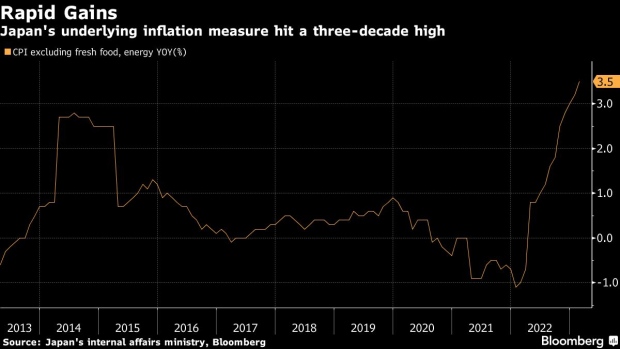

Fast forward to today, and the economy Ueda is tackling is still below its pre-pandemic level, and faces risk of a global slowdown making the recovery even slower. Inflation dynamics have shown increasing signs of shifting as businesses pass higher costs onto consumers at the fastest pace in decades, and deciding to raise wages by the most since the early 1990s.

As a professor at the University of Tokyo, Ueda impressed his students by reading mathematical formula as quickly as he read sentences, and instantly spotting flaws, according to Takuya Nakaizumi. Around three decades ago, he was among the first students in Ueda’s seminar group at the University of Tokyo.

Impressed by Ueda, Nakaizumi introduced him as ‘a future BOJ governor’ to his mother at his wedding ceremony in 2005. Nakaizumi is currently an economics professor at Kanto Gakuin University in central Japan.

“Ueda is an extremely rare economist who is entirely capable of making accurate economic projections, while also thoroughly understanding economic theories,” Nakaizumi said. “He appreciates theories including their limits, so he isn’t obsessed with any specific theory.”

Outside of the class room, Ueda, a lover of wine, enjoyed drinking with students occasionally and sometimes participated in karaoke, Nakaizumi recalled. Ueda was good at singing and his favorite song was an 80s number called Pink Sigh by Japanese singer Mariko Takahashi, he said.

Motoshige Itoh, a professor emeritus at the University of Tokyo, has known Ueda for half a century, starting from their time as college classmates. Itoh was impressed by Ueda’s economic insight, but also by his ability to handle administrative tasks.

“He isn’t a man of many words,” Itoh said. “But he speaks up when needed. He is well trusted among us.”

Ueda showed signs of competence from an early age, according to Rokuro Ueda, Ueda’s uncle. When the now BOJ governor was around 10, he visited his grandparents’ house in Sagara town in Shizuoka prefecture, traveling alone for several hours by train.

At the time, the young Ueda was carrying around a transistor radio, Rokuro recalled. He was listening to English programs, something done very rarely among Japanese at the time, and didn’t stop even after his grandfather interrupted him, he said.

Rokuro recently sent his nephew a message congratulating him and urging him to make sure he stays healthy as he tackles the hectic schedule of a central bank chief.

“He wrote back — jokingly saying that he’ll come back to Sagara if this doesn’t work out,” Rokuro said.

(Updates with details of Ueda’s inaugural presser)

©2023 Bloomberg L.P.