Aug 23, 2022

UK Energy Crisis Could Knock Pound to $1.14, JPMorgan Warns

, Bloomberg News

(Bloomberg) --

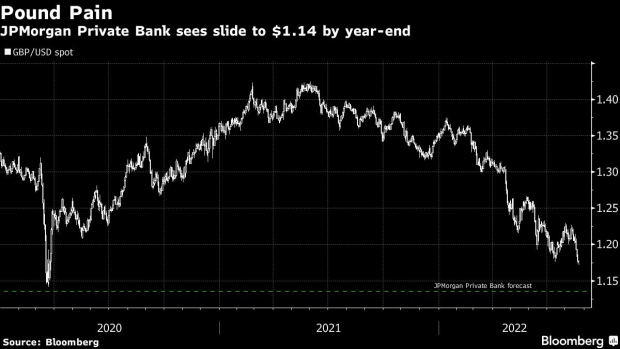

The pound risks falling to its lowest versus the dollar in more than two years if a gas supply crisis this winter pushes the UK into recession, according to JPMorgan Private Bank.

Already down 12% against the greenback so far this year, the UK currency is starting to reflect concerns that higher gas prices will fan inflation as economic growth contracts, said Sam Zief, head of global FX strategy at JPMorgan Private Bank.

A pound at $1.14 is “absolutely within reach if gas prices continue to do what they are doing,” Zief said in an interview.

Traders had recently shifted to selling the pound because of UK problems compared with earlier in the year, when the currency’s weakness was more a case of dollar strength, Zief said. The pound rebounded Tuesday, climbing back above $1.18, although remains near its lowest level since March 2020.

EURO-AREA INSIGHT: Recession Looms as Putin Tightens the Screws

Natural gas prices have surged globally after Russia’s invasion of Ukraine intensified a global energy crunch. Higher prices are expected to deepen the hit to UK household finances, while the threat of shortages could further slow economic activity in the country.

Zief also predicted more losses for the euro, saying he expects the currency to fall to 95 US cents by the end of December if gas prices stay at or exceed currently elevated levels. The energy crisis across the continent will keep the euro trading around 0.8500 to the pound, he added.

(Updates prices in pars 2 and 4)

©2022 Bloomberg L.P.