Dec 29, 2023

Uruguay’s Central Bank Cuts Key Rate to 9% on Tame Inflation

, Bloomberg News

(Bloomberg) -- Uruguay’s central bank lowered its benchmark interest rate by 25 basis points to 9% at its final policy meeting of the year and signaled its satisfaction with the pace of consumer price increases and inflation expectations.

With Friday’s cut, the central bank led by economist Diego Labat has reduced borrowing costs by 250 basis points since April. Policymakers said in a statement following the decision that monetary policy should continue to seek an inflation rate at the midpoint of the 3% to 6% target.

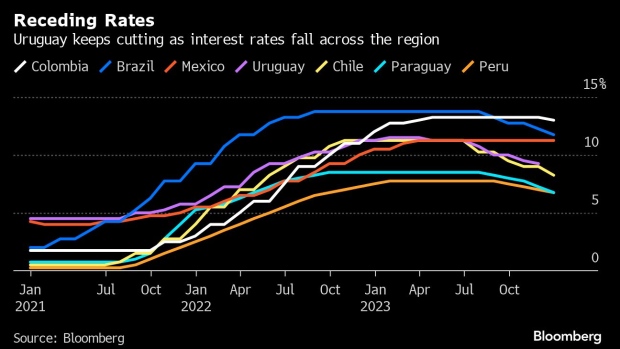

Borrowing costs are retreating across the region as central banks roll back monetary tightening campaigns that largely succeeded in taming the surge in inflation that followed the pandemic. Colombia joined the rate-cutting club earlier this month with a 25-basis point reduction, while Mexico is still holding its key rate at a multi-year high.

Uruguay’s inflation has remained within the target range for six straight months thanks to tight monetary policy, a strong currency and weak growth stemming from a deep drought in the first half of the year. But there is still a wide gap between the central bank’s inflation outlook and that of market participants.

Policymakers see consumer price gains staying on target through the end of 2025, when inflation is expected to rise to 5.3%. Analysts who participated in the central bank’s most recent survey see inflation accelerating to 6.44% by the end of next year before slowing to 6.1% in November 2025.

The central bank also said it expects the economy to continue expanding in the fourth quarter of this year and the first quarter of 2024.

©2023 Bloomberg L.P.