Mar 24, 2023

US Business Equipment Orders Rise While Broader Durable Goods Decline

, Bloomberg News

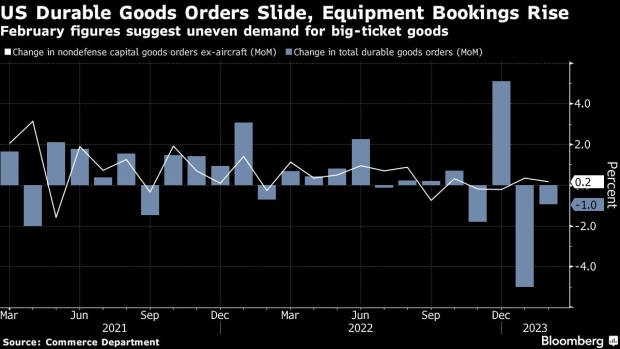

(Bloomberg) -- Orders for all durable goods declined unexpectedly in February, even as business equipment demand ticked up.

Bookings for all durable goods — items meant to last at least three years — fell 1% in February after plunging 5% in the prior month, Commerce Department figures showed Friday. Excluding transportation equipment, durable goods orders were unchanged.

The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, rose 0.2% last month after a 0.3% advance in January. The data aren’t adjusted for inflation.

The median forecast in a Bloomberg survey called for core capital goods bookings to fall 0.2%. January was previously reported as a 0.8% increase. Economists expected orders for all durable goods to rise 0.2%.

Even with the pickup in core capital goods orders, the figures suggest a year’s worth of interest-rate hikes from the Federal Reserve may be starting to curb investment plans. That could deteriorate further under rising economic uncertainty tied to an evolving banking crisis and slower growth in corporate profits.

“We will have to wait a few months to see whether businesses are forced to trim back their investment plans due to tighter credit,” Stephen Stanley, chief US economist at Santander US Capital Markets LLC. “Business investment is definitely a vulnerability for the economy in the event of a severe tightening in credit conditions.”

Outside of a gain in core capital goods, orders were largely weaker. Bookings for computers, transportation equipment, machinery and communications gear all declined.

Core capital goods shipments, a figure that is used to help calculate equipment investment in the government’s gross domestic product report, were unchanged.

What Bloomberg Economics Says...

“Going forward, non-essential capex will remain on the back burner as growth concerns rise. The soft result for core capital-goods shipments is a sign of weakness ahead, given deteriorating capex intentions.”

— Eliza Winger, economist

To read the full note, click here

The Commerce Department’s report showed bookings for commercial aircraft, which are volatile from month to month, decreased 6.6%. Boeing Co. reported five orders in February, compared with 55 in January.

While often helpful to compare the two, aircraft orders are volatile and the government data don’t always correlate with the planemaker’s monthly figures.

Survey data have shown some improvement in the manufacturing sector but it remains broadly weak. The Institute for Supply Management’s gauge of factory activity ticked up in February from the weakest print since May 2020, while a separate Fed measure unexpectedly increased last month.

Friday’s report showed unfilled orders for all durable goods edged lower while inventories picked up.

Defense capital goods orders declined 7.4%. Excluding defense, bookings for durable goods also fell.

--With assistance from Kristy Scheuble.

(Adds Bloomberg Economics comment)

©2023 Bloomberg L.P.