Mar 26, 2024

US Consumer Confidence Holds Steady While Outlook Deteriorates

, Bloomberg News

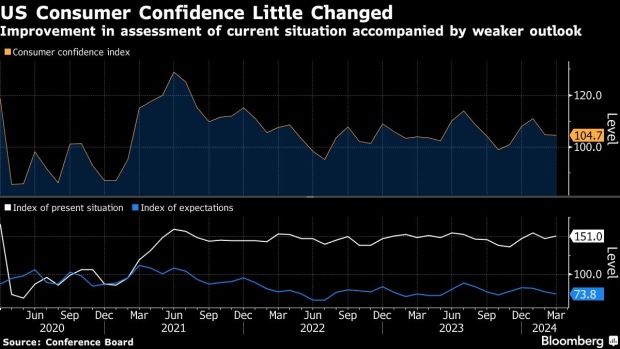

(Bloomberg) -- US consumer confidence held steady in March as Americans were sanguine about their current situations but grew slightly more pessimistic about the outlook.

The Conference Board’s gauge of sentiment ticked down to 104.7 from a downwardly revised 104.8 a month earlier, data out Tuesday showed. The median estimate in a Bloomberg survey of economists called for a reading of 107.

A measure of expectations fell to 73.8, the lowest since October, while the gauge of current conditions picked up to 151.

Though consumer confidence had been generally improving in recent months, still-high prices and soaring borrowing costs are weighing on Americans’ purchasing power. Furthermore, the gradual cooling of the labor market could limit optimism in the near term.

While respondents don’t see inflation reaccelerating or much of a risk of a recession, they appear to be more concerned about the election, the report indicated. A separate survey also suggested that consumer sentiment is in somewhat of a holding pattern as voters await November’s outcome for direction on the economy.

“Consumers expressed more concern about the US political environment compared to prior months,” Dana Peterson, chief economist at the Conference Board, said in a statement. “Over the last six months, confidence has been moving sideways with no real trend to the upside or downside either by income or age group.”

Inflation Expectations

Despite robust back-to-back inflation readings at the start of the year, consumers seemed unfazed. The average anticipated inflation rate over the next 12 months held near the lowest level in four years.

Consumers were still upbeat about the current state of the labor market. The share of consumers who said jobs were currently plentiful rose to the highest since July, while those who said they were hard to get dropped to the lowest in about a year.

The difference between those two — a metric closely followed by economists to gauge labor-market strength — also advanced to the highest in eight months.

Looking six months ahead, however, respondents were generally more negative about the outlook for business conditions, their income and the labor market. They were also somewhat less optimistic about their family’s financial situation.

Roughly one in four consumers anticipate spending more on health care, motor-vehicle services and lodging for personal travel this year, according to a supplemental question in the survey. On a six-month basis, buying plans for interest-rate sensitive items like cars, homes and major appliances fell.

--With assistance from Kristy Scheuble.

(Adds graphic)

©2024 Bloomberg L.P.