May 5, 2020

Wayfair soars to record after retailer's positive forecast

, Bloomberg News

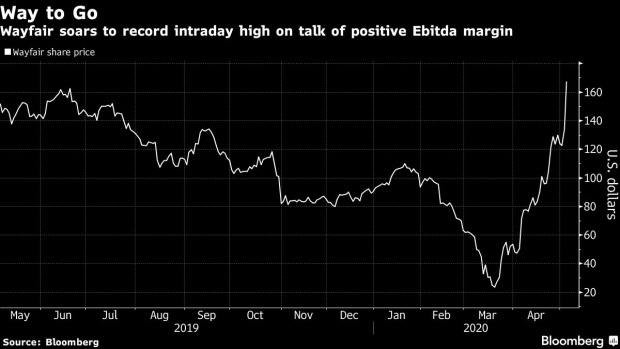

Wayfair Inc. soared to a record high Tuesday after investors cheered the company’s profitability forecast and demand trends as the coronavirus pandemic drives more consumers to shop online.

Executives of the home-good retailer said on a conference call that the adjusted margin for earnings before interest, taxes, depreciation and amortization would turn positive this quarter compared with the negative 5.5 per cent reported for the first quarter.

The shares surged as much as 35 per cent to $181.39, the highest intraday level since the company went public in 2014.

Results will be driven by expanding gross margin, more efficient marketing and gaining a better hold on operating expenses “while still aggressively investing into the future,” said Chief Executive Officer Niraj Shah, noting this reflects only the current rate of quarterly revenue growth of around 20 per cent. “All incremental revenue will be additive and we would expect it to create significant additional profitability this quarter.”

Wayfair began seeing a pickup in mid-March of both traffic and conversion, or visitors that actually make a purchase. The increase in online demand across categories has “continued to gain momentum” in April, and the company has seen “millions of new customers” over the past several weeks, Shah said. It’s also seeing “strong repeat trends” from long-term and new customers.

The stock has rebounded about 660 per cent since March 19, when it reached an intraday low of $21.70, driven by fears of supply chain issues in China and lingering concerns over a fourth-quarter shortfall. Management’s comments Tuesday on demand trends seem to confirm more recent bullish moves by investors.

Etsy Gains

Wayfair’s momentum carried over to another online retailer. Etsy Inc. shares climbed as much as 11 per cent to a record high as investors bet that the digital retailer of unique, often handcrafted, items will provide as rosy an update when it reports first-quarter results Wednesday.

Boston-based Wayfair said it’s not sure how long these positive trends will last, and as such, management declined to provide a specific revenue forecast for the second quarter. Wall Street is predicting a 24 per cent year-over-year advance, besting the 20 per cent growth reported for the March quarter.

The company has 13 buy ratings, 13 holds, and six sells, with an average 12-month price target of $95, which implies a 44 per cent decline from current levels, according to Bloomberg data.