Mar 9, 2020

What the oil plunge means for global economic growth

, Bloomberg News

Oil Crash Sends New Shock Through World Economy Reeling from Coronavirus

VIDEO SIGN OUT

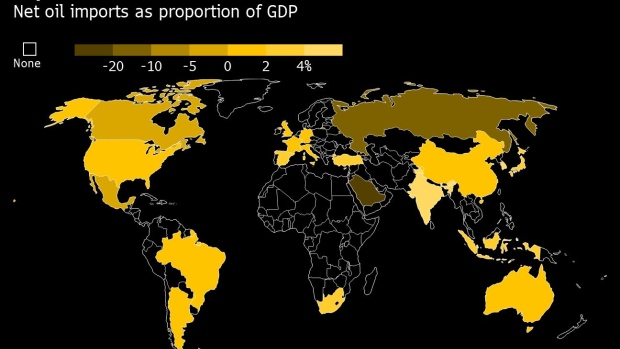

A supply-driven drop in oil prices would normally be a positive for global growth, cutting costs for businesses and putting more money in consumers’ pockets.

This time, that might not be the case, according to Bloomberg Economics: Producers will still lose -- though evidently Saudi Arabia sees long-term benefits from squeezing higher-cost competitors.

Consumers will gain, but with the risk of a coronavirus-induced shutdown looming, they might not have the motive or opportunity to divert their energy savings to other spending.