Jun 18, 2020

Wirecard Showdown Stuns Analysts, Raises Liquidity Questions

, Bloomberg News

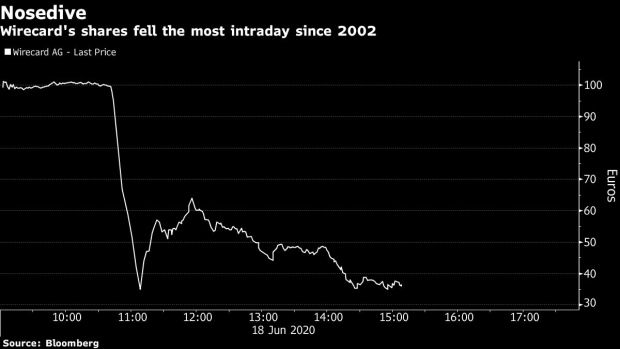

(Bloomberg) -- Wirecard shares plunged as much as 66% after the company delayed publication of its annual financial results for the fourth time and revealed that auditors were unable to find about 1.9 billion euros ($2.1 billion) in cash.

Analysts and investors said the company is losing what little was left of investors’ trust. Focus will turn to liquidity, they added, as the payment firms faces a potential termination of loan agreements that threatens its very existence.

Here is what analyst and investors had to say:

NordLB, Wolfgang Donie

(rating cut to sell from hold)

- “It looks like the last remaining speck of investors’ trust has been squandered.”

- Wirecard’s situation can only be described as untenable, as the scandal has ballooned into a crisis threatening the company’s existence and degenerating the stock into a gambling bet.

- Advises investors to stay away from the stock and slashes its price target to 20 euros from 80 euros.

Mirabaud, Neil Campling

(sell)

- “Wirecard’s retreat could be terminal.”

- Questions must be asked about the company’s ability to maintain its Visa and MasterCard licenses.

- Today’s developments could have far-reaching consequences for its ability to operate worldwide.

Morgan Stanley, Adam Wood

(equal-weight)

- Wirecard’s acknowledgment that failure to complete an audit by June 19 may lead to the termination of 2 billion euros in loans moves the focus to its balance sheet and liquidity.

- Calculates that if 1.9 billion euros of cash balances cannot be verified, Wirecard might only have 220 million euros of available cash

- Would expect Wirecard to seek covenant waivers if banks call the debt

Deka, Ingo Speich

- “We are stunned.”

- Says a fresh start in management personnel is more urgent than ever.

Keefe, Bruyette & Woods, Sanjay Sakhrani

(market perform)

- Says latest developments provide credence to the allegations raised by the Financial Times and some investors around the spurious nature of Wirecard’s Third Party Acquiring business

©2020 Bloomberg L.P.