Mar 29, 2019

With Lyft IPO, a new breed of unicorns ride in to Wall Street

A new wave of Silicon Valley’s prized unicorns are making their way to Wall Street. Ride-hailing company Lyft Inc. is leading the way with the first high-profile initial public offering for the tech industry of 2019. Lyft will soon be followed by rival Uber Technologies Inc. and online image search company Pinterest Inc.

All three tech companies have a few things in common: Sky-high valuations, fast-growing revenue, and a lack of profitability.

“Lyft, Uber and Pinterest are attempting to be more than the simple apps they started out to be,” venture capitalist Peter Misek of Framework Venture Partners told BNN Bloomberg in an email. “The lack of profits has to be balanced with the ability to grow with incremental profitability – meaning each new sale on its own must be profitable over a short period of time. World class companies show this at scale.”

While investor appetite for these money-losing businesses appears to be robust, their financials look somewhat different when compared to past IPOs of the tech industry’s biggest players.

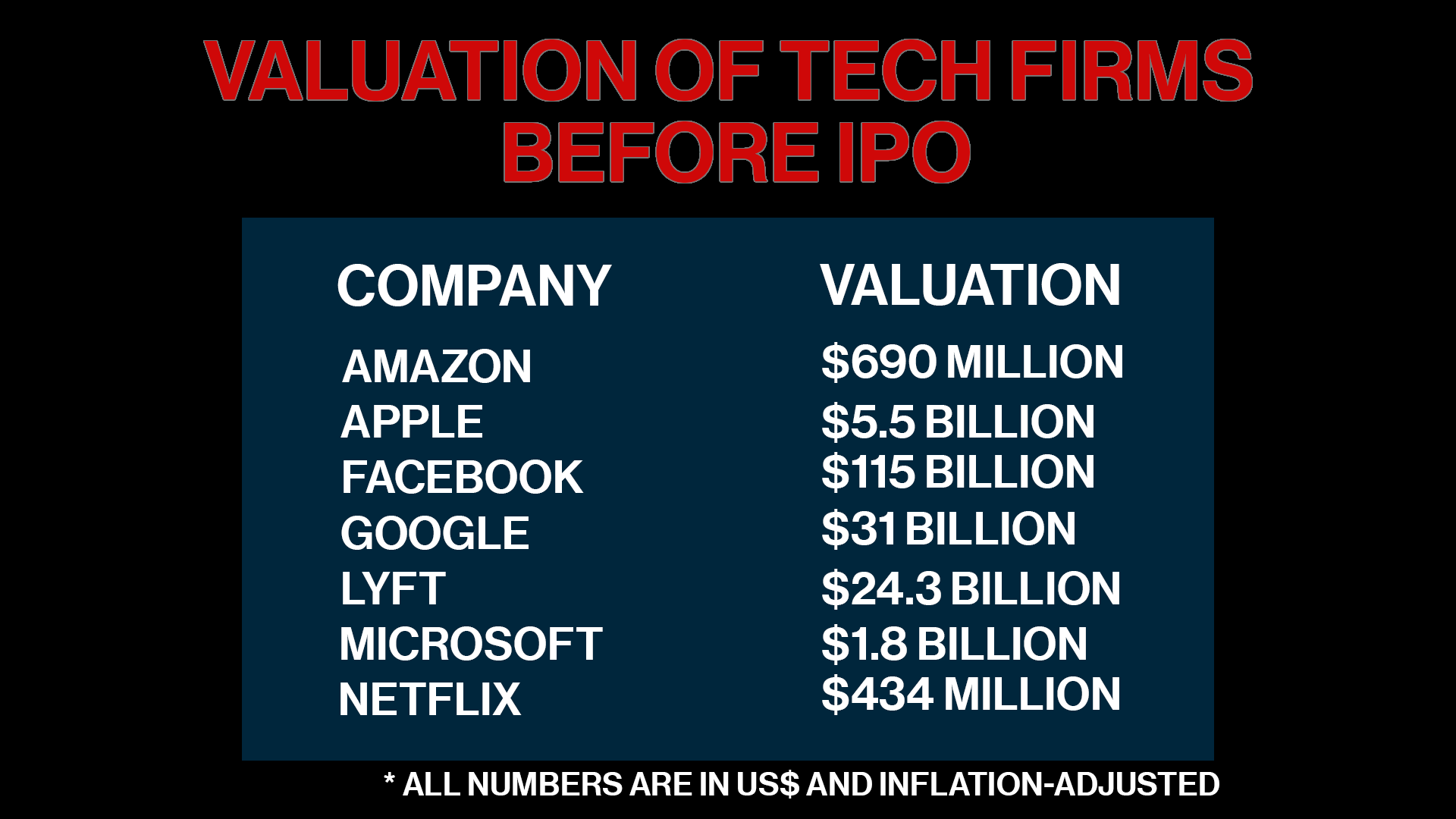

A BNN Bloomberg analysis of Apple Inc., Amazon.com Inc., Google (now Alphabet Inc.), Facebook Inc., Microsoft Corp. and Netflix Inc. suggests most of those companies went public at more reasonable valuations and in many cases, with more proven profitability.

For example, while Netflix and Amazon were money losers in the years ahead of their initial public offerings, Apple, Microsoft, Google and Facebook were running profitable businesses.

“There have been a select few companies such as Amazon that have sustained long-term losses in their ‘winner take all’ journeys to platform domination,” venture capitalist John Ruffolo, co-founder of the Council of Canadian Innovators, told BNN Bloomberg in an email.

“But for the vast majority of companies, unless you can clearly establish positive unit economics and temporarily reinvest your profits in hyper-growth, there will be trouble ahead for those companies with lofty valuations with no prospect for profits in sight.”

WEIGH IN

What’s your preferred ride service?

Seven-year-old Lyft lost a whopping US$911 million last year. Investors are hoping the San Francisco-based company’s top-line growth will help eat away at those losses. Its revenue more than doubled last year to reach US$2.2 billion.

By comparison, Uber, which could be headed towards a US$120-billion IPO valuation, posted revenue last year of more than US$11 billion, up 43 per cent from 2017. Its losses, however, were enormous, at US$1.8 billion, which was actually an improvement from a US$2.2 billion loss in 2017.

As for Pinterest – which already sports a private-market valuation of more than US$12 billion – its revenue reached US$756 million in 2018. That’s up from US$473 million the year before. On the bottom line, Pinterest lost US$63 million last year, down from a US$130-million loss in 2017.

“What I have found is that when you look at any high-valuation stocks, there is a chance that some will perform well and, to be very candid, some will also disappoint,” former Cisco CEO John Chambers, who runs venture capital firm JC2 Ventures, told BNN Bloomberg in an email.

Indeed, there have been recent examples of high-flying IPOs that turned into flameouts for investors.

Take Snapchat’s parent Snap Inc., which in the year ahead of its IPO lost nearly US$515 million. Despite its profit problems, investors piled into Snap’s public offering, pushing its valuation to US$29 billion by the end of the first day of trading. Two years later, Snap is still losing money and its stalled user base has left investors disheartened. Snap’s valuation today is half of what it was when it went public.

Even companies with more appealing profit pictures can stumble. In 2014, GoPro Inc. went public at a valuation of nearly US$3 billion, after displaying a history of profitability. While its stock initially soared in the months after the offering, a steady slowdown in camera sales has pulled its valuation down two-thirds since IPO day.

Venture capitalists have been hungry to cash in on unicorn hype, which helps to partly explain surging valuations. A report from the National Venture Capital Association and PitchBook found VC funds in the U.S. raised more than US$55 billion from investors last year, which was the most since the dot-com era.

For the most part, the VCs plowing money into these unicorns have accepted that profit problems are a cost of doing business.

“Capital to fund losses to stimulate growth is the purpose of risk capital and how modern industries and economies are built. There is risk, though -- sometimes unacceptably high levels of risk – based on many factors: Market opportunity, operational excellence and technological prowess,” Framework’s Misek said.

Lyft, Uber and Pinterest could soon be joined on Wall Street by other unicorns. Messaging platform Slack Technologies Inc., which currently sports a US$7.1-billion private-market valuation, is gearing up for its own offering. Co-working company WeWork Cos., which has been valued at US$47 billion but lost US$1.9 billion last year, is preparing for an IPO. And Airbnb Inc., which has a valuation of about US$35 billion, could also go public in the next year.

“My view overall is that this new wave of IPOs is certainly welcome. In fact, we need many more startups to go public in the coming years because startups will fuel drive economic growth, job creation, innovation and inclusion in the future,” JC2 Ventures’ Chambers said.

Below is a recap of past IPOs for some of the tech industry's biggest players:

APPLE:

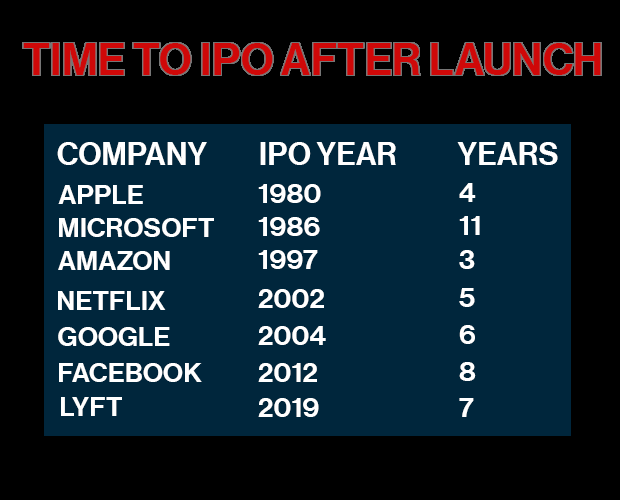

Apple was a four-year-old company when it went public in 1980. Apple was coming off a year in which it generated nearly US$118 million in revenue, growing 150 per cent from US$774,000 in 1977. In today’s values, that revenue would be more like US$360 million, while the company’s US$11.7 million profit would be closer to US$35 million.

Apple’s US$1.78-billion IPO valuation adjusts to roughly US$5.5 billion in today’s prices. For context, that’s less than one per cent of the company’s current market capitalization.

AMAZON:

Amazon went public earlier than most big tech players, completing its IPO at just three years old. At the time, it was coming off a year where it generated roughly US$16 million in revenue, a big jump from the modest US$511,000 in its first year of business.

Amazon, which at the time described itself as "Earth's biggest bookstore,” faced a profitability problem from the beginning, with some analysts pointing to a near US$6-million loss in the year before its IPO as a red flag for investors.

GOOGLE:

Google went public in 2004, six years after its launch. The company’s US$23-billion valuation seemed lofty at the time (it clocks in at more than US$30 billion today if you adjust for inflation), but the company was also printing money. Google was coming off a year where its revenue soared 177 per cent to more than US$960 million on a profit of roughly US$107 million. Google also encouraged investors by revealing it had been profitable since 2001.

FACEBOOK:

Few tech players have faced more IPO hype than Facebook. At the time of its public market debut in 2012, it was the second largest IPO of all time. Its US$104-billion valuation meant that Facebook was worth more than companies such as McDonald’s Corp., Citigroup Inc., Amazon and United Parcel Service Inc.

Facebook waited eight years before going public, giving it time to scale and become profitable. In the year before its IPO, Facebook posted US$3.7 billion in revenue on a profit of US$1 billion, which compared to a loss the previous year.

Still, pricing its stock at roughly 100 times the previous year’s profits made for a hefty valuation when compared to the 14 times earnings multiple for the average company in the S&P 500.

Of course, Facebook lived up to the hype and then some, with its profits topping US$22 billion last year.

MICROSOFT:

One of tech’s most influential companies displayed plenty of patience before its IPO. Microsoft waited 11 years to make its market debut, which reflects Bill Gates’ reluctance to go public. Gates’ control of the company coupled with limited pressure from venture capitalists allowed Microsoft to stay private longer than most tech players.

And while some companies bleed cash in the lead-up to an IPO, Microsoft was generating more than US$140 million in revenue, which would be equivalent to US$330 million in today’s prices. Its US$24-million profit in that same year capped off a four-year run, during which the company generated about US$50 million in profit.

NETFLIX:

Netflix waited five years for its IPO, making its public market debut in 2002. The company that started as a mail-order DVD rental service would have gone public sooner, but plummeting dot-com stock values forced Netflix to put those plans on hold. Its US$309-million valuation (US$434 billion in today’s values) seems modest by today’s standards. However, Netflix still had much to prove. The company, which at the time had 600,000 subscribers (it now has nearly 150 million), was coming off a year where it lost nearly US$39 million on revenue of roughly US$76 million.