Sep 7, 2023

Wizz Says Airline Deal Dents Milan Competition, Seeks to Expand

, Bloomberg News

(Bloomberg) -- Wizz Air Holdings Plc wants to expand at Milan’s Linate airport and sees the pending deal between Italy’s flagship carrier ITA Airways and Deutsche Lufthansa AG as an opportunity to extend its Italian footprint.

The two Wizz competitors will have about a 70% share of capacity at Linate once they become partners, Robert Carey, president of the low-cost carrier, said in an interview. He raised concerns about competition at the hub — a favorite of business travelers for its proximity to Milan’s center — at a meeting with Italian Industry Minister Adolfo Urso on Wednesday.

“You really need to liberalize the market in Linate, both to provide competition and to get access to low fares,” Carey said in an interview. It’s “an aim on which we agree with the Italian government.”

Lufthansa agreed in May to acquire an initial 41% of ITA, the state-owned company that succeeded Alitalia. While it’s common for one airline to have a dominant presence at a given airport, a 50% share is more typical, Carey said.

“It’s fine to have an airline with leadership, but you need to have a meaningful competitor at No. 2 to connect the major cities,” he said.

A spokesperson for the Industry Ministry declined to comment. ITA declined to comment.

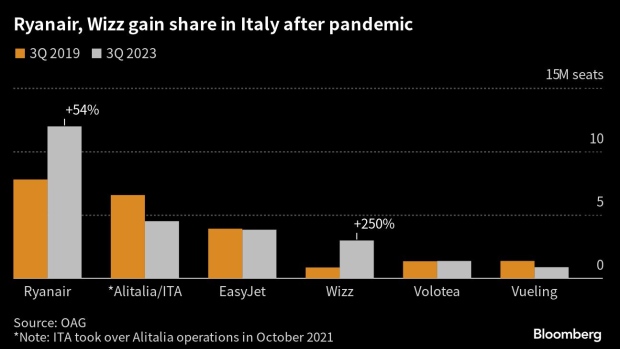

Wizz has grown quickly in Italy since the Covid-19 pandemic and is challenging EasyJet Plc’s position behind market leaders Ryanair Holdings Plc and ITA, according to data from OAG. Still, Wizz’s share at Linate is only around 3-4%, Carey said, with only service to Catania in Sicily.

Competitors are likely to raise concerns about Linate with the European Commission, Carey said. The commission which could impose remedies on the Lufthansa-ITA deal.

The talks with Urso are part of a series of meetings with airlines to discuss the sector broadly, after Italian Prime Minister Giorgia Meloni issued a decree in August capping ticket prices from Italy’s mainland to Sicily and Sardinia.

Read: Meloni Weighs Further Aviation Moves After Italian Price Caps

Carey characterized the meeting with Urso as a positive exchange of views, while reiterating Wizz’s opposition to price caps.

While everyone agrees on the goal of ensuring prices aren’t overly high in certain markets, “it can be done in many different ways,” Carey said. “A price cap is not the best one, for sure.”

©2023 Bloomberg L.P.