Sep 1, 2022

Worst China Property Earnings Since 2008 Signal More Stock Angst

, Bloomberg News

(Bloomberg) -- China’s property developers posted their worst first-half earnings in over a decade, an outcome that will likely pressure stocks further even as the government boosts efforts to stabilize the sector.

Total net income for the 136 real estate companies that reported earnings in Hong Kong and China slumped 87% in the first six months of the year to just 17.6 billion yuan ($2.5 billion), according to Bloomberg data. That makes it the worst half year since data was available in 2008.

A clampdown on leverage, China’s strict Covid Zero policy and a weakening economy was to blame for much of the fallout in the property sector this year. Country Garden Holdings Co., the largest builder by sales, warned that the crisis has yet to bottom after reporting net income tumbled by a record 96%. Logan Group Co. swung to a net loss of 540.6 million yuan.

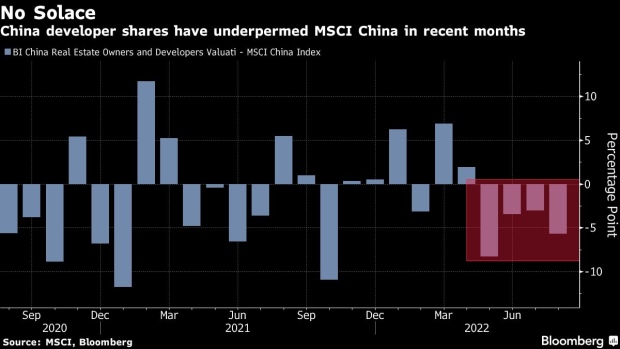

Government plans to lower mortgage rates and offer guarantees on some upcoming onshore bond offerings have done little to lift sentiment, with a gauge of property developers down 27% so far this year. The cash crunch has pushed China’s corporate-bond defaults to a record.

“We continue to struggle to get a true sense of the bottoms for earnings given developers’ flexibility to slow completions (as cash flows remain tight), which hurts revenue bookings, and price cuts, which hurt margins,” HSBC Holdings Plc. analysts led by Michelle Kwok wrote in a note on Wednesday. The bank added it is making meaningful cuts to its 2022 earnings estimates.

Great Divide

The earnings season offered greater clarity into the winners and losers from the ongoing property woes. State- and semi-state-owned firms like China Vanke Co. managed to fare better than their privately-owned peers thanks to their strong cash positions and ability to navigate the many pitfalls.

“China’s real estate development market will likely become dominated by SOEs, supplemented by healthier private firms that are obedient to the authorities,” said Naoto Saito, chief researcher at Daiwa Institute of Research.

Private firms saw their liquidity woes deepen in the first half of the year, according to UBS Group AG, with cash holdings down 19% compared with a 2% drop for state-owned companies like China Resources Land Ltd. and China Overseas Land & Investment Ltd.

State-owned firms were also able to borrow more in the first half of the year, the bank added. These companies saw total debt rising 11% compared to their private peers, which saw levels fall by 5%. All this has implications for chances of survival, analysts including John Lam wrote in a recent note.

Investors say the best end game is a consolidation of the sector to avoid a deflationary spiral where too many companies compete in a shrinking market. That would also take pressure off housing prices. Before then, there will be little opportunity for upside.

“What we need to see from China is more of a targeted approach in terms of the property space, meaning that the most effective way I think in the near term would be some sort of sector consolidation,” Ben Luk, a senior multi-asset strategist at State Street Global Markets. He added the firm has essentially avoided the sector altogether for some time.

©2022 Bloomberg L.P.