Mar 16, 2023

Yen Demand Catapults as Banking Crisis Wrecks US, Europe Havens

, Bloomberg News

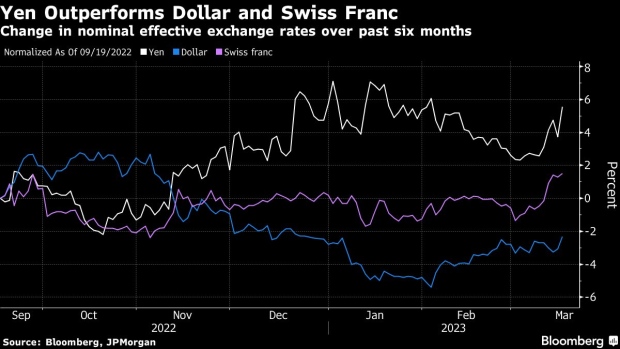

(Bloomberg) -- The yen is making a push to regain its crown as the go-to haven as a banking crisis dents the appeal of its US and European peers.

Japan’s currency has outperformed all its Group-of-10 counterparts in the past five days as traders sought the safest assets amid a surge in volatility. In contrast, a gauge of the dollar sank 0.7% in the immediate aftermath of Silicon Valley Bank’s collapse while the Swiss franc dropped as much as 2% Wednesday.

“The yen is being seen as a safe haven again, and there appear to be very few of those at the moment,” said Andrew Ticehurst, a rates strategist at Nomura Holdings Inc. in Sydney. “With SVB impacting the US dollar as Fed rate hikes get put in doubt, and Credit Suisse impacting ECB thinking and the euro and Swiss franc outlook, the yen can buck the trend.”

The turmoil in the banking sector is reshaping the outlook for monetary tightening, as investors speculate that the crisis may stay the hand of central banks. Upcoming policy reviews by the European Central Bank and the Federal Reserve are the next event risk, with some investors warning that authorities may continue to tighten to tame inflation.

The expected peak for the Fed policy rate — which exceeded 5.5% less than a week ago — is down to about 4.85%, pricing in an increase in May, with a quarter-point hike at next week’s review deemed a coin toss. Traders see the ECB opting for a quarter-point increase on Thursday, compared with expectations for a half-point hike last week.

Analysts are similarly less enthused about the franc as the currency’s fortunes are seen to be closely linked to those of troubled lender Credit Suisse Group AG. The bank is seeking funding from the Swiss National Bank to shore up investor confidence and Chief Executive Officer Ulrich Koerner has said its financial position is sound.

“The yen seems more popular now than the Swiss franc, which is another safe currency, due to the emergence of the Credit Suisse issue,” said Ayako Sera, strategist at Sumitomo Mitsui Trust Bank Ltd. in Tokyo. “Safety is the key word in the market right now.”

Surplus Challenges

Still, Japan’s currency has several factors working against it. For one, the nation would probably require overseas money to help fund a record current-account deficit, and this may expose the yen to volatile foreign flows.

Japan’s ultra-low rates are another worry, and any further Fed tightening may widen the rate gap and unleash another wave of selling in the yen.

But until that happens, Japan’s currency looks likely to continue attracting buyers for now, strategists said.

“We see recent developments as USD bearish,” Patrick Bennett, strategist at Canadian Imperial Bank of Commerce, wrote in a note. He forecasts dollar-yen falling to 123 in the third quarter from around 133 now.

--With assistance from Masaki Kondo and Yumi Teso.

©2023 Bloomberg L.P.