Mar 6, 2024

Yen Gains With Bank Stocks as Wages, BOJ Remarks Lift Hike Bets

, Bloomberg News

(Bloomberg) -- The yen climbed to a one-month high and Japanese bank shares rose after strong wage data and comments from central bank policymakers bolstered speculation that negative interest rates will be scrapped this month.

Declines in Japanese government bonds extended after poor demand for a sale 30-year sovereign debt. Policy-sensitive two-year notes also fell, with their yield climbing to 0.195%, the highest level since 2011.

Volatile overnight indexed swaps at one point showed a 79% chance a rate increase by this month’s Bank of Japan meeting, three times higher than the reading at the end of last month. They returned to around 50% as of 4:10 p.m. in Tokyo.

Data released Thursday showed Japanese wage growth accelerated at the fastest clip since June, as the BOJ closely watches whether higher pay fuels inflation. Meanwhile, the Japanese Trade Union Confederation, known as Rengo, said its affiliated unions demanded an average wage increase of 5.85% at this year’s spring pay talks, the highest in 30 years.

Several government officials support a rate increase in the near term, according to people familiar with the matter, while central bank board member Junko Nakagawa said the nation’s economy is steadily making progress toward the authority’s 2% price target. Governor Kazuo Ueda told parliament the certainty for hitting the BOJ’s price target is increasing gradually.

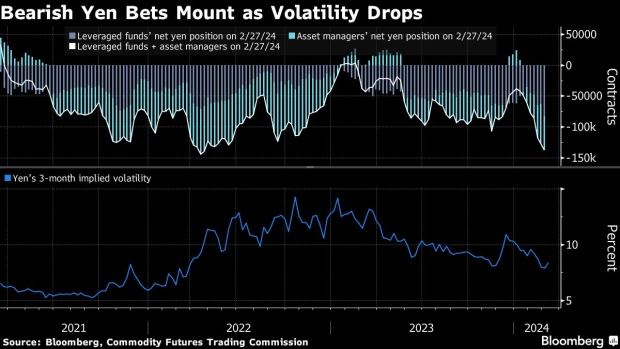

Those developments spurred the yen to gain as much as 0.9% to 148.03 against the dollar, while the benchmark 10-year bond yield increased as much as 2 basis points to 0.73%. The yen’s rally came even as Commodity Futures Trading Commission data for the period ended Feb. 27 showed that hedge funds boosted their short positions on the Japanese currency to the most bearish in more than six years.

“Everything is pointing to yen buying,” said Takeshi Ishida, a strategist at Resona Holdings Inc. in Tokyo. “After an excessive drop in yen volatility and a buildup of yen shorts, both are susceptible to unwinding.”

Ueda said the BOJ is paying attention to spring wage negotiations from standpoint of a virtuous cycle of wages and prices.

“Rengo’s demand came in as a strong side, supporting the case for a March rate hike and spurring more short-covering of the yen,” said Wako Ogawa, director of foreign-exchange sales at Deutsche Securities Inc. in Tokyo. “The current yen’s rise may be caused mainly by the short-covering move, creating a good opportunity for dip-buying.”

Speculation of higher interest rates also supported Japanese bank shares, with the Topix banks index rising for a third day, climbing 1.5%. That stood in contrast to the blue-chip Nikkei 225 gauge, which fell 1.2%.

--With assistance from Daisuke Sakai.

(Adds union pay demand, analyst comment, latest prices)

©2024 Bloomberg L.P.