Sep 21, 2022

Yen Weakens to 145 Per Dollar After BOJ Holds Rates Steady

, Bloomberg News

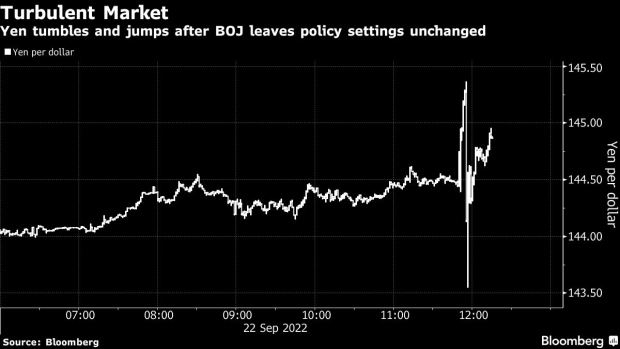

(Bloomberg) -- The yen briefly tumbled past the key level of 145 per dollar after the Bank of Japan kept policy settings on hold, bringing it closer to a threshold that may invite intervention by the authorities.

Japan’s currency slid as much as 0.9% to 145.37, the lowest since August 1998, before trading about 0.6% weaker at 12.30 p.m. local time. The BOJ’s policy decision widens the divergence with the Federal Reserve which delivered its fifth interest-rate hike this year on Wednesday and signaled more tightening to tame inflation.

The yen’s descent brings it within striking distance of the 146.78 level where the authorities last stepped in to prop it up in 1998. Hedge funds have been adding to bearish bets on the currency, which has tumbled more than 20% this year, with Goldman Sachs Group Inc. warning it may decline all the way to 155.

“The only thing that can stop USD/JPY from rising toward 150 is Japanese FX intervention,” said Alvin Tan, head of Asia FX strategy at RBC Capital Markets. “But even then it will only be a temporary respite.”

Talk of direct invention by the authorities has gained momentum after the yen’s recent decline. Officials stepped up verbal warnings and the BOJ was said to have conducted a so-called rate-check on Sept. 14, a move that’s seen as a precursor to intervention.

Traders betting against the yen may get another chance to push it lower when Japan’s market is shut on Sept. 23 for a holiday, said Daisuke Uno, chief strategist at Sumitomo Mitsui Banking Corp. in Tokyo.

(Updates throughout)

©2022 Bloomberg L.P.