Mar 28, 2023

A Single Bet on Deutsche Bank’s Credit Default Swaps Is Seen Behind Friday’s Rout

, Bloomberg News

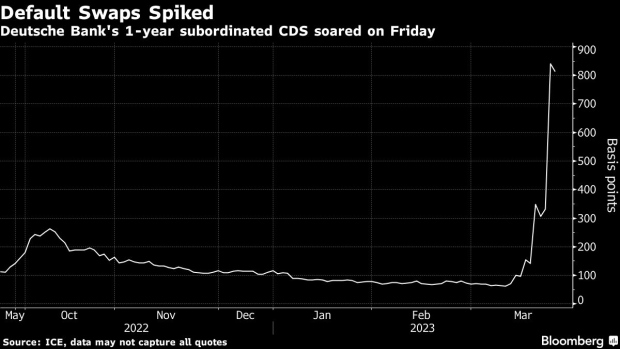

(Bloomberg) -- Regulators are singling out a trade on Deutsche Bank AG’s credit default swaps that they suspect fueled a global sell off on Friday.

It was a roughly €5 million ($5.4 million) bet on swaps tied to the German bank’s junior debt, according to people familiar with the matter, who said regulators have spoken to market participants about the transaction. The contracts can be illiquid, so a single bet can trigger big moves. A spokesperson for Deutsche Bank declined to comment.

The suspected knock-on effect was a rout that sent banking stocks tumbling, government bonds higher and CDS prices for lenders soaring, trimming about €1.6 billion off Deutsche Bank’s market value and more than €30 billion off an index that tracks European banking stocks. That’s because investors have been on edge since the collapse of several US banks and rescue of Credit Suisse Group AG, with the market searching for clues on whether other lenders would also face strain.

European banks and their regulators have sought to underline that they have a close watch on risks — including rising rates — and that the industry is on a sound footing. Amid the unwanted attention, the German lender published a presentation on Monday that cited its “well diversified portfolio” of deposits, a key focus for investors following the collapse of Silicon Valley Bank. Deutsche Bank and the broader index rebounded on Monday, erasing some of Friday’s losses.

“Investors see Deutsche Bank as one of the higher beta names; so in case you want to bet generally against weak sentiment, then these kind of names may be interesting,” said Suvi Platerink Kosonen, a banking credit analyst at ING Groep NV.

It’s unclear who placed the relevant bet or why they did it. And there’s no evidence so far of anything nefarious about the trade, said the people. Some data point to the trades being for hedging purposes, said one of the people. There’s also a transaction on Deutsche Bank’s five-year, senior CDS contracts executed on Thursday that attracted scrutiny, one of the people said.

Illiquid Market

Of Deutsche Bank’s CDS contracts, the most actively traded were the dollar denominated, five-year swaps tied to the lender’s senior debt, with at least $51 million notional in the two days through Friday, according to DTCC data compiled by Bloomberg. The number is probably higher, given that reported data for single trades is capped at around $5 million. The trading volumes for the euro-denominated contracts instead stood at around €12 million across all instruments during the same period.

The search for triggers underscores a general lack of transparency in the asset class, which Andrea Enria, the ECB’s top oversight official, flagged on Tuesday. He also called for global financial regulators to take a closer look at the CDS market. The European Central Bank is Deutsche Bank’s top banking regulator, but that watchdog doesn’t oversee securities trading, meaning pursuing any irregularities is the purview of market regulators.

“There are markets like the single name CDS market which are very opaque, very shallow, very illiquid,” Enria said at a conference hosted by German newspaper Handelsblatt. “With a few millions, you can move the CDS spreads” of a major bank “and contaminate also stock prices and possibly also deposit outflows,” he said, without naming any banks.

--With assistance from Alastair Marsh, Abhinav Ramnarayan, Ksenia Galouchko, Giulia Morpurgo and Tasos Vossos.

(Updates with wider volume of CDS in the seventh paragraph)

©2023 Bloomberg L.P.