Oct 18, 2022

Abortion Pill Startups Face Challenges Raising Cash—Even Post-Roe

, Bloomberg News

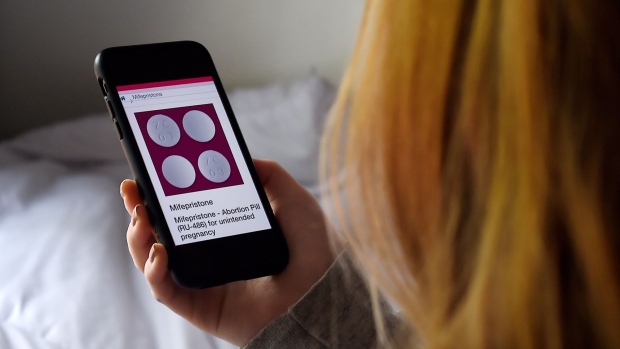

(Bloomberg) -- Startups that provide abortion pills by mail saw a groundswell of attention after the Supreme Court overturned Roe v. Wade earlier this year. Today, though, the founders of two abortion pill companies say that raising money from investors has been complicated.

Hey Jane, which provides Mifepristone pills for inducing abortions to patients in eight states, recently closed a $6.1 million funding round, the company told Bloomberg. The round, which was oversubscribed, came mostly from female investors, Hey Jane said.

Co-founder and CEO Kiki Freedman said that during the fundraising process she found that many investors were interested in backing businesses expanding access to abortion care, but added, “I’d be lying if I said it was easy.” Numerous firms told her they couldn’t invest in a business focused on abortion access because their limited partners, who supply capital, would be wary of the politics involved. “They may not want to ruffle feathers with their own investors,” she said.

On Tuesday, President Joe Biden vowed to enshrine Roe v. Wade in federal law, a promise that hinges on the Democrats’ ability to hold the House and make gains in the Senate in the upcoming midterm elections. Until then, access to an abortion is subject to the political climate in each state.

About 20,000 people have received abortion medication from Hey Jane since its launch in early 2021. The funding brings the startup’s total cash raised to $9.7 million, a relatively small sum in the world of venture capital, but the round exceeded the amount Hey Jane initially set out to raise. Freedman said the funding will help grow Hey Jane’s staff and expand its virtual care model to include other areas like postpartum depression. The company plans to introduce that program in all 50 states by the end of next year. Investors in Hey Jane’s latest funding round include New York-based VC the Helm, Ulu Ventures and Amboy Street Ventures, which focuses on sexual health startups and women’s health technology.

Over the summer, after reports that Supreme Court was planning to overturn Roe v. Wade, companies seeking to expand access to abortion care saw an influx of inbound interest from investors wanting to talk about their businesses. Choix Inc., another company that mails pills that patients can use to induce an abortion, raised $1 million in seed funding over the summer from Oregon-based Elevate Capital.

But since then, Choix has struggled to raise more money. Earlier this month, the startup launched a crowdfunding campaign on Republic, a site that allows people to invest in companies as well as other projects. Choix went the crowdfunding route after failing to raise the additional $1 million it was hoping to bring in as part of its summer round. (Freedman said Hey Jane also raised some money from investors on tech investing platform AngelList, and found about 100 backers there.)

Choix’s co-founder and CEO, Cindy Adam, said that like Freedman, she found that investors were hesitant to fund abortion-related companies because of worries over their limited partners’ politics. Another common reason VCs passed was that they’re looking for profitability, particularly during a market downturn. “Lots of investors want to see profits,” Adam said. “We’re focused on quality care and taking care of our patients over profits.”

There are a number of other telehealth companies focused on abortion access and women’s health. On Wednesday, a business called Wisp said it had expanded its abortion medication offering to nine states, after launching in California this summer.

Carli Sapir, a Hey Jane investor and founding partner at Amboy Street Ventures, said that startups catering to women are often overlooked. In the case of abortion access, the topic is so politicized that “a lot of people won’t touch this space for fear of repercussions,” she said. Still, Sapir is optimistic about the future of startups focused on women’s health. “I know this space is underserved and underfunded,” she said. “But there’s a huge shift in the landscape right now because women are becoming decision-makers in the VC landscape and directing the flow of capital.”

(Updates with context on telehealth companies in the ninth paragraph.)

©2022 Bloomberg L.P.