Feb 16, 2022

Airbnb beats the pandemic with ‘best year’ yet; shares rise

, Bloomberg News

If you're travelling this winter, be sure to get insurance: RATESDOTCA's John Shmuel

Airbnb Inc. beat revenue and profit estimates in the fourth quarter, bucking a resurgent wave of COVID-19 infections and heading into this year even stronger than before the pandemic. The shares rose.

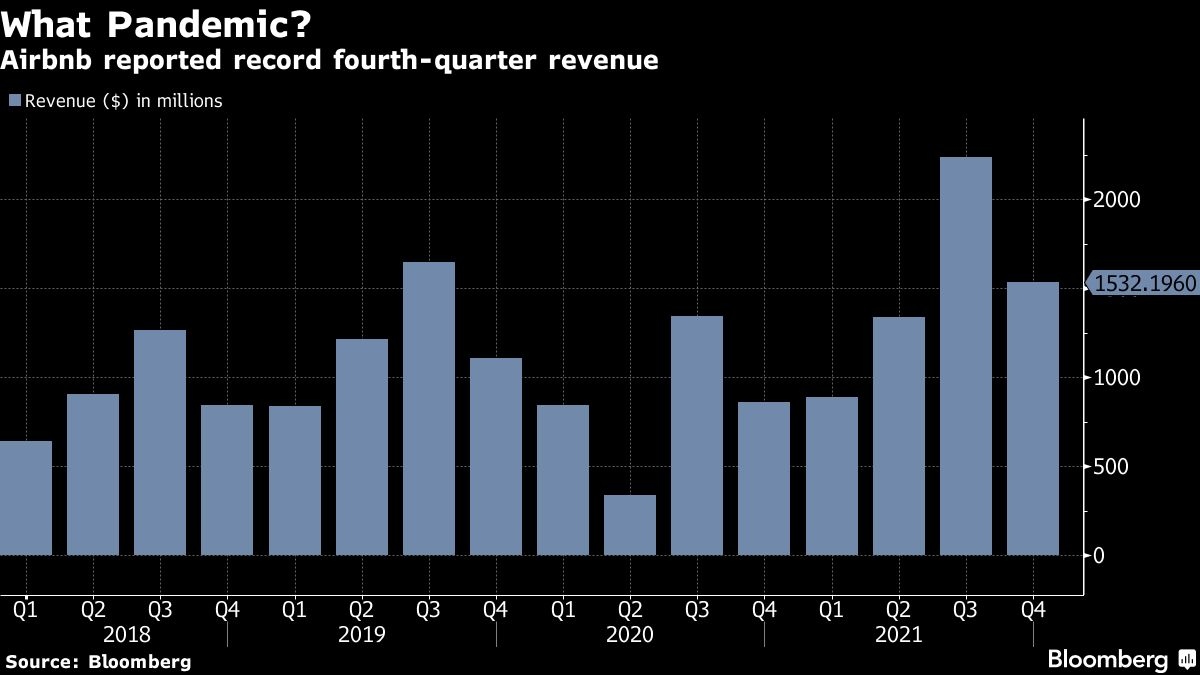

Revenue grew 78 per cent to US$1.53 billion, Airbnb said Tuesday in a statement. That beat analysts’ projections for US$1.46 billion. The San Francisco-based company reported net income of US$55 million compared with a loss of US$3.9 billion a year earlier, marking a record for the period. Earnings per share were 8 cents, compared with estimates for 3 cents.

Chief Executive Officer Brian Chesky called the results “the best year in our company’s history,” and said that Airbnb was able to weather the pandemic because of its highly adaptable business model. “We have millions of types of homes in nearly every community at nearly every price point all over the world,” he said in an interview with Bloomberg Television on Tuesday. “That means that however travel changes, we’re able to adapt.”

Airbnb has recovered from the beginning of the pandemic, when the company cut thousands of jobs and considered delaying its initial public offering as travel ground to a halt around the world. After the initial shock, business boomed as workers no longer had to be in traditional offices five days a week and could work from anywhere. “As a result,” Airbnb said in a letter to shareholders, “people are spreading out to thousands of towns and cities, staying for weeks, months or even entire seasons at a time.”

Almost half of the number of nights booked in the fourth quarter were for stays of a week or longer and one in five nights were for stays of a month or more.

In the early days of the pandemic, many people sought out homes in more rural areas within driving distance of big cities, though Airbnb said guests are now starting to return to cities. In the fourth quarter, gross nights booked at urban destinations accelerated from the previous quarter and have nearly recovered to 2019 levels for the same period.

Airbnb remained resilient even as the omicron variant of COVID-19 swooped in late last year, re-shuttering businesses and disrupting flights and vacation plans over the holiday season. The company said it saw a lower impact on bookings and cancellations with omicron than it had with the delta variant. Rival Expedia Group Inc., which provides reservations for hotels and alternative accommodations through its Vrbo platform, has also weathered the COVID resurgence, reporting revenue that more than doubled in the fourth quarter.

With U.S. inflation running at a four-decade high, Chesky said it may spur more people to become hosts. Individuals and families will look for economic opportunity to “make it through this time,” and they can make US$9,000 to US$10,000 a year hosting occasionally, he said. The average day rate for Airbnb bookings has increased in high-traffic areas, and the higher prices have helped boost revenue, Chesky said on a conference call with analysts.

In the interview Tuesday, Chesky said that the increase in rates was partly due to inflation but that the primary reason was the changing mix of where people are choosing to stay -- often in more expensive locations in the U.S., and with larger numbers of people.

Airbnb said it’s “encouraged” by what it is seeing so far this year. “The impact of omicron has quickly dissipated and guests are confidently booking for the summer travel season early in the year,” the company said. Airbnb now expects the number of nights and experiences booked in the first quarter to “significantly exceed” the first-quarter levels of 2019.

Revenue is expected to be US$1.41 billion to US$1.48 billion in the first quarter, Airbnb said.

The shares gained as much as 3.5 per cent on Wednesday in New York. The stock has lagged behind Expedia this year, chalking up gains of 8 per cent compared with its rival’s 17 per cent leap. Many analysts raised their price target on Airbnb stock.

Chesky views the disruptions of traditional work culture as a boon to the company’s business model because employees have more flexibility to work from anywhere. He is even spending several months “living” in Airbnb rentals himself. “One thing I learned is it’s important to have really good Wi-Fi,” he quipped.

To embrace the change in what travelers are looking for in the pandemic era, Airbnb now lets guests search for listings as long as a year in advance. But its futurism has limits. Chesky said Airbnb has no immediate plans to offer crypto payments: “We are absolutely, as promised, looking into crypto payments,” he said. “I don’t have anything to announce right now.”