Aug 17, 2023

Americans Credit the Fed for Inflation Cooldown in Consumer Survey

, Bloomberg News

(Bloomberg) -- Americans think the Federal Reserve could soon be taking a victory lap.

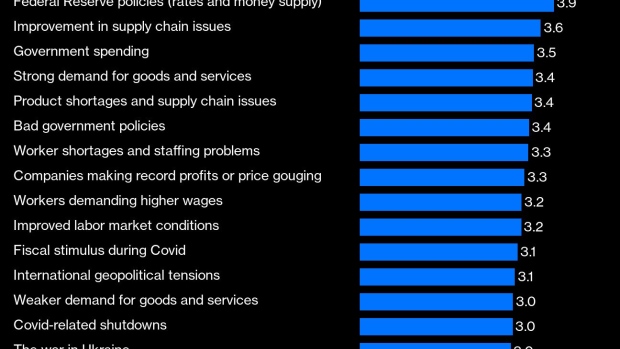

US consumers largely credit actions taken by the Fed, followed by improvements in supply-chain issues, as the main factors explaining why inflation has cooled over the past year, according to a New York Fed survey. Those were also the top two factors listed as reasons why the inflation rate may continue to drop in the coming year.

When asked what drove inflation up between 2019 and 2022, respondents mostly blamed supply-chain challenges, including product shortages, Covid-related shutdowns and a lack of workers as the top factors pushing prices higher.

“Our results suggest that consumers believe supply-chain issues — a deterioration first followed by improvements — was among the main reasons behind the sharp inflation movements the US economy has experienced since 2020,” New York Fed researchers wrote in a blog post published Thursday.

Consumer-price inflation has cooled substantially over the past year and is now about a third of where it was in June of 2022, when price growth soared to a 40-year high. Consumer-inflation expectations as measured by the University of Michigan also unexpectedly fell in early August, despite higher gasoline and grocery costs.

The progress is promising for the US central bank, which lifted its benchmark rate in July to a target range of 5.25% to 5.5%, the highest level in 22 years, in an effort to cool demand and ease pricing pressures. But with inflation still above the Fed’s 2% target, policymakers are not ready to rule out further interest rate increases.

Minutes from the Fed’s July meeting showed officials then largely remained concerned that inflation would fail to recede and that further interest-rate increases would be needed. At the same time, cracks in that consensus were also becoming more apparent, with two Fed officials saying they could have supported leaving rates unchanged.

Read More: Fed Officials Shift Rates Debate From ‘How High’ to ‘How Long’

Key economic data published since the July gathering have mostly supported the notion that Fed officials will have some time to deliberate over the need for more tightening.

Many policymakers will gather next week at the Kansas City Fed’s annual Jackson Hole conference in Wyoming, and the next policy meeting is set for Sept. 19-20.

©2023 Bloomberg L.P.