Feb 13, 2023

U.S. stocks close higher as wage survey eases CPI fears

, Bloomberg News

BNN Bloomberg's closing bell update: Feb. 13, 2023

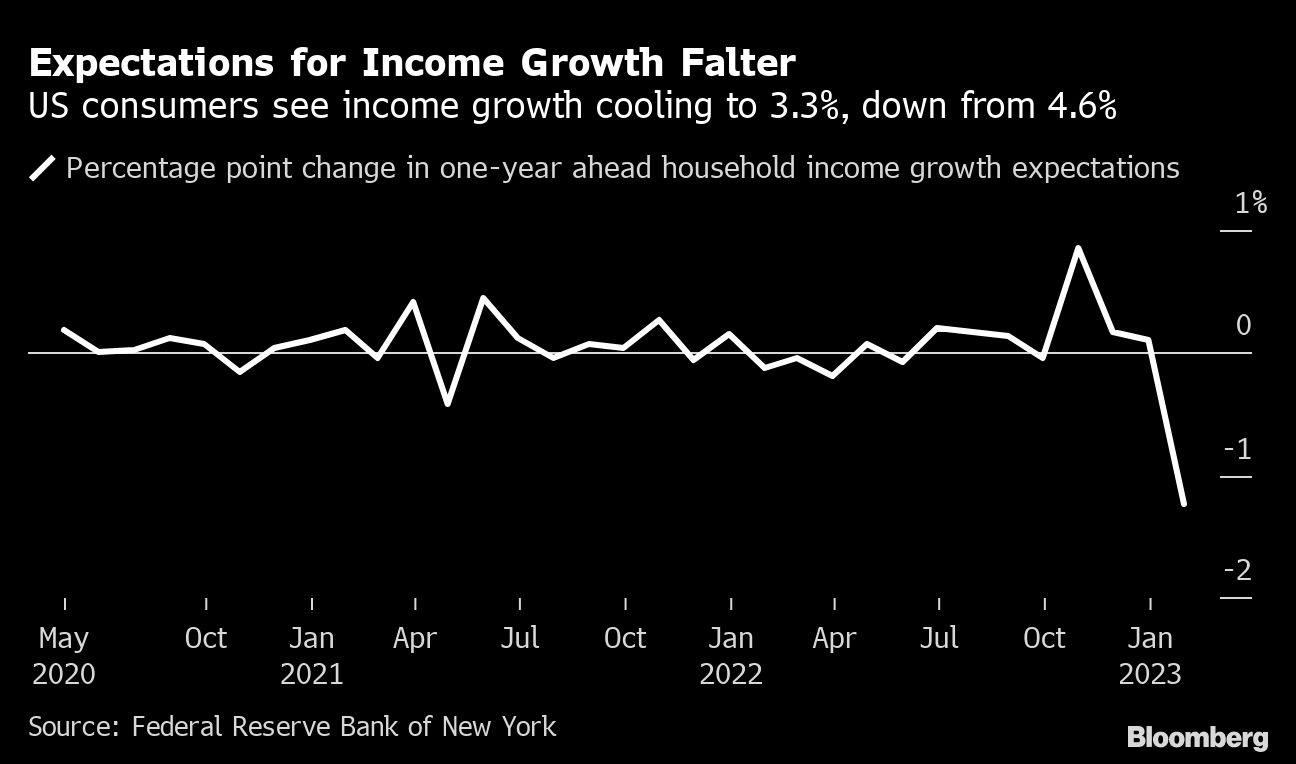

U.S. stocks ended Monday with broad gains after a survey showing Americans have drastically reduced their expectations for household income growth suggested that Tuesday’s consumer price data might not be as bad as once feared.

The S&P 500 added 1.1 per cent, with every sector save energy in the green. The tech-heavy Nasdaq 100 rose 1.6 per cent following its first weekly loss of 2023. The Dow Jones Industrial Average gained the most since January.

A New York Federal Reserve consumer survey showed that one-year inflation expectations were little changed in January, which was “modestly reassuring” for Vital Knowledge’s Adam Crisafulli.

“The household income piece was positive (for stocks) in that it points to wage disinflation expectations,” he wrote, noting it was the largest one-month drop in the nearly 10-year history of the series.

Oil prices, a key inflation component, fell on a report that the Biden administration plans to sell more crude oil from the Strategic Petroleum Reserve. West Texas Intermediate crude futures dropped below US$80 a barrel.

Yet two-year Treasury yields rose to a new high for the year after climbing 23 basis points last week following the much stronger-than-expected January employment data.

Traders are reassessing how high U.S. interest rates will rise this year, with inflation and jobs data looming later this week. This has fueled bets for the Fed rate to peak at 5.2 per cent in July, up from less than 5 per cent a month ago.

Equity indexes climbed Monday despite warnings from prominent strategists. JPMorgan Chase & Co.’s Marko Kolanovic said that investors should be in bonds since “a recession is currently not priced into equity markets.” The team led by Morgan Stanley’s Michael Wilson argued that U.S. stocks are ripe for a selloff after prematurely pricing in a pause in Fed rate hikes.

“While equity and credit markets have priced a soft landing based on peaking short-term rates and inflation, we view recent action as another bear market rally, turbocharged by a surge in U.S. dollar liquidity, weak positioning and short covering,” wrote Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management. “Furthermore, the rosy view is unconfirmed by other capital markets, with economic data reflecting complex crosscurrents from the extraordinary COVID reopening.”

Yet Alexandra Wilson-Elizondo, head of multi-asset retail investing at Goldman Sachs Asset Management, thinks the market rally could have legs over the next few months.

“We’ve strongly believed that the handoff from goods disinflation to services was going to take time and that the Fed would have to remain in restrictive territory to do that,” she said in a phone interview. “And so we’ve maintained a cautious positioning in our portfolios, but we looked to real fundamental catalysts for those relative value trades such as the China reopening.”

Art Hogan, chief market strategist at B. Riley, said that equities’ positive moves Monday were due to investors seeing the glass as “half full.”

“There are more tailwinds than headwinds in this market right now,” he said in a phone interview. “There’s a lot more going right than going wrong and investors are reacting that way — at least today in front of the CPI report.”

But Irene Tunkel, chief U.S. equity strategist at BCA Research, says that concerns about inflation will soon be replaced by concerns about economic growth.

“The market is already celebrating a soft-landing, they’re celebrating the end of inflation,” she said in a phone interview. “But I don’t think that we are out woods yet because I think there is a narrow window between inflation turning and growth slowing in a more sort of acute way.”

In Europe, optimism over resilient economic growth pushed European equities higher. The Stoxx 600 index was lifted by construction, industrial goods and consumer stocks while energy and real estate underperformed.

India’s inflation rate of 6.5 per cent breached the top end of the central bank’s target for the first time in three months. The yen weakened past 132 per dollar after whipsawing Friday following news reports that Kazuo Ueda would be picked to become the Bank of Japan’s next governor. Japan’s government is set to officially announce the nomination of the new BOJ governor on Tuesday.

Traders are also keeping a keen eye on geopolitical developments after the Pentagon shot down an unidentified object that it tracked over Michigan, according to U.S. officials familiar with the matter. This was the fourth time in eight days a balloon or high-flying craft has been shot down over the U.S. or Canada.

Key events:

U.S. CPI, UK jobless claims, Eurozone GDP, New York Fed President John Williams gives the keynote speech at New York Bankers Association event Tuesday

Japan’s new BOJ governor nomination Tuesday

U.S. retail sales, UK CPI Wednesday

U.S. jobless claims, Australia unemployment, Cleveland Fed President Loretta Mester speaks at Global Interdependence Center event Thursday

France CPI, Russia GDP Friday

Some of the main moves in markets:

Stocks

The S&P 500 rose 1.1 per cent, more than any closing gain since Feb. 7 as of 4 p.m. New York time

The Nasdaq 100 rose 1.6 per cent, more than any closing gain since Feb. 7

The Dow Jones Industrial Average rose 1.1 per cent, more than any closing gain since Jan. 6

The MSCI World index fell 0.3 per cent, falling for the third straight day, the longest losing streak since Jan. 19

Currencies

The Bloomberg Dollar Spot Index fell 0.2 per cent, more than any closing loss since Feb. 7

The euro surged 0.4 per cent, more than any closing gain since Feb. 1

The British pound surged 0.6 per cent, more than any closing gain since Jan. 17

The Japanese yen fell 0.7 per cent to 132.30 per dollar

Cryptocurrencies

Bitcoin fell 0.3 per cent to US$21,681.76

Ether fell 1.4 per cent to US$1,490.24

Bonds

The yield on 10-year Treasuries declined three basis points to 3.71 per cent

Germany’s 10-year yield was little changed at 2.37 per cent

Britain’s 10-year yield was little changed at 3.40 per cent

Commodities

West Texas Intermediate crude fell 0.5 per cent to US$79.29 a barrel

Gold futures fell 0.6 per cent to US$1,864 an ounce