Jul 19, 2022

Big Yen Short Is Over for Global Traders Even as Tokyo Piles In

, Bloomberg News

(Bloomberg) -- It may be the surprise of seeing prices at home go up for the first time in decades, but a split seems to be forming between a growing number of bearish yen watchers in Tokyo and their more positive foreign counterparts.

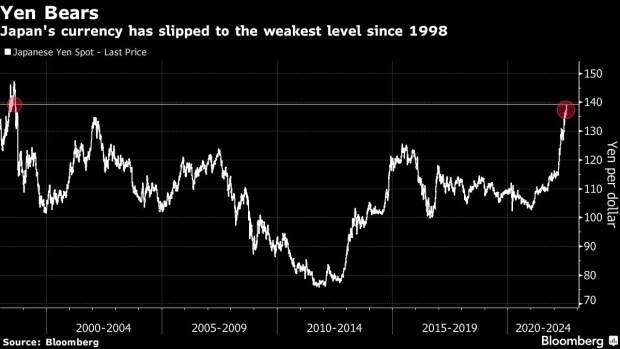

Having fallen to a 24-year low, strategists are debating whether one of the year’s hottest macro trades -- sell the yen -- is overdone. Those in Japan suggest there’s still plenty of time to pile on shorts. Not so, according to analysts from Sydney to Geneva who say time is nearly up on the trade as the yen slips further toward the key psychological level of 140 per dollar.

The path of the yen is being closely-watched by markets, with bets on a further decline increasingly seen as the most stretched macro trade, according to a recent Bank of America survey of fund managers. Japan’s interest-rate gap with the rest of the world, higher oil prices in the import-dependent nation and the resurgent greenback have already pushed the currency 17% lower for the year -- the worst performer among Group-of-10 peers.

“A weaker yen is inevitable” as the Bank of Japan continues with easy monetary policy, said Takuya Kanda, general manager at Gaitame.com Research Institute in Tokyo, whose base case is 142 per dollar. Still, there will be room for a little more upside for dollar-yen if interest rates rise in the US,” with 147 a possibility, he added.

The Bears

Kanda joins a throng of currency bears in Japan -- a country on the brink of a historic tipping point in inflation, where “enyasu” -- or weak yen -- is lamented as public enemy number one.

BOJ’s Kuroda Determined to Maintain Stimulus as World Tightens

NLI Research Institute’s Tsuyoshi Ueno reckons there are “no clear factors to make the yen stronger” as BOJ Governor Haruhiko Kuroda rams home the message that it’s too early to relinquish easy policy. Perpetuating yen weakness is the greenback reaching new highs as investors embrace the dollar smile argument -- which suggests the US currency can benefit both in times of strong growth and during an economic slowdown.

“There are still opportunities to short the yen,” said Ueno, who sees it testing 145 against the dollar. “Japan will be the only country with negative interest rates, and the yen will be the leading funding currency.”

It’s a sentiment echoed by Tatsuhiro Iwashige at Fivestar Asset Management Co. For the Tokyo-based analyst, a “realistic target” of 160 per dollar, a level last seen in 1990, could be the yen’s future reality.

The currency’s slide “is justified by the Japan-U.S. interest rate differential and trade deficit,” said Iwashige. “At the current level of 139 yen, there is still plenty of room to add to yen selling positions.”

Forget Treasuries, These Three Catalysts May Force Yen Past 140

The Bulls

But almost 10,000 kilometers away in Geneva, Pictet Wealth Management is trumpeting a vastly different message.

There is limited scope for rate differentials -- a key driver for the yen’s poor performance -- to turn any more negative in the months ahead as recession risks percolate, analyst Luc Luyet wrote in a recent note.

That trend may be under way. The spread between five-year US and Japanese inflation-adjusted yields has narrowed from a mid-June high, a decline yet to be matched by the dollar-yen which has tracked the differential all year.

“The deterioration in the economic outlook should put a lid on interest rates globally, potentially providing a more supportive environment for the low-yielding yen,” Luyet wrote. He sees the yen erasing its year-to-date losses to trade back at the 120 level this time next year.

National Australia Bank Ltd. strategists are also wary of the extreme pessimism bombarding the world’s third-most traded currency.

“An overshoot towards 145 cannot be ruled out, but the bigger the rise the harder the fall,” Sydney-based Rodrigo Catril, who sees the currency potentially in the low 130s by year end, wrote in a note.

The yen will rally to finish the year at 132 per dollar, according to a poll of analysts by Bloomberg.

The Undecided

Of course not every analyst in Tokyo is bearish, nor every foreign strategist a bull. Yukio Ishizuki, a senior currency strategist at Daiwa Securities, expects the yen to gradually strengthen toward 130 per dollar next year, while Saxo Capital Markets’ Jessica Amir sees the potential for a drop to 145.

And as the dollar goes from strength to strength, some such as HSBC Holdings Plc’s Joey Chew are opting to refrain from making a hard call on how best to trade Japan’s currency. Instead, she prefers to be flexible as traditional correlations between the yen and Treasuries break down.

“Whichever method you use, the yen looks undervalued,” said Hong Kong-based Chew. “We just raised our third-quarter forecasts to 140, although there is still a risk of it overshooting.”

©2022 Bloomberg L.P.