Jan 16, 2024

CFOs Are Grabbing More CEO Jobs

, Bloomberg News

(Bloomberg) -- Newell Brands Inc., the company behind Rubbermaid and Sharpie, made deep cuts in recent years to simplify operations that included slashing its product varieties, or stock keeping units, by 75%.

That track record helped Chris Peterson rise from the company’s chief financial officer to president and then chief executive in May. Such mobility placed him in a growing cohort of CFOs who advanced to the top job. To make that jump, executives on the finance side of a company also need be well-versed in what drives growth, according to Peterson.

“I spent most of my time in strategy and operations,” said Peterson, who worked outside of finance in previous career stops, including at Ralph Lauren Corp. and Revlon Inc.

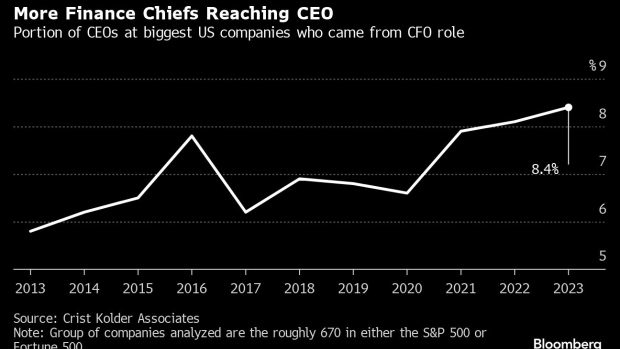

CFOs have historically been known for number crunching, but they are increasingly taking on more operational responsibilities. That helped a record number of finance chiefs ascend to the top job last year at America’s biggest companies. Among the firms represented in the S&P 500 and Fortune 500, 8.4% of them promoted a finance chief to CEO, according to exclusive data from Crist Kolder Associates, an executive search firm. That’s up from 5.8% a decade ago.

“CFOs are taking on a more operational role in those businesses, ingratiating themselves,” said Josh Crist, a co-managing partner at Crist Kolder. “The more you can grab as CFO, the more likely you will have chances at the top gig.”

The recruiter expects the trend to continue as companies tighten their belts amid an uncertain outlook for the US economy, thus putting CFOs in a position to excel.

Despite the increasing success of CFOs, working as chief operating officer remains the clearest path to CEO. Nearly 50% of CEOs who came from within an organization were in COO-type roles, according to Crist Kolder.

Last year saw lots of companies give their finance chiefs additional responsibilities. That included Marriott International Inc. handing CFO Leeny Oberg the role of growing the hotel operator’s lodging portfolio, helping ensure the company had the financial resources to go after its growth strategy for the unit, she said.

The ascendancy of finance chiefs might also help more women reach the top job as they hold about 19% of CFO positions at big US firms, according to Crist Kolder. A couple years ago, Julie Sloat was running a unit of American Electric Power Co. She got promoted to CFO in 2021 and then CEO early last year.

“It’s all about knowing all aspects of your business,” she said, referring to her transition to the CEO role.

Overall, the CFO job is becoming more volatile, with turnover increasing and tenures declining. There with 120 changes last year among the roughly 670 companies in either the S&P 500 or Fortune 500, a 50% jump from two years ago. Firms spanning American Express Co. to Campbell Soup Co. and Tesla Inc. were included.

©2024 Bloomberg L.P.