Apr 13, 2023

China Exports Unexpectedly Rise in Positive Sign for Economy

, Bloomberg News

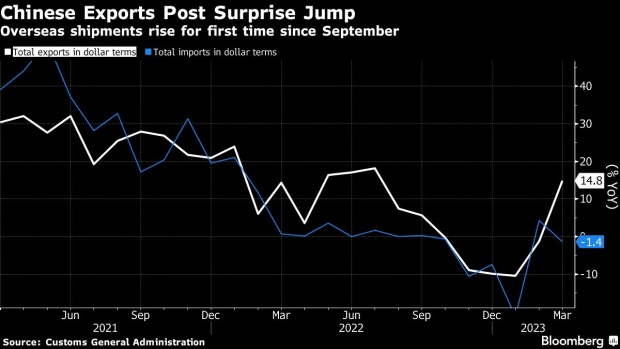

(Bloomberg) -- China’s exports unexpectedly rose in March as demand from most Asian countries and Europe improved and as the nation’s factories resumed production, boosting the economy’s outlook and indicating global growth may be better than expected.

Exports jumped 14.8% in US dollar terms last month from a year earlier, partly driven by a uptick in shipments to southeast Asian nations and resilient demand from South Korea and Europe. Economists had forecast a more than 7% fall, and the surprisingly strong result was the biggest divergence from expectations since at least 2018.

Imports declined 1.4%, the customs administration said Thursday in Beijing, leaving a trade surplus of $88.2 billion for the month.

Over the past three years, booming export demand was a strong support for the world’s second-largest economy, and helped compensate for weak domestic spending caused by the country’s housing market slump and Covid Zero restrictions. Exports began to contract from late 2022 as demand from the US, the European Union and other countries all lost momentum. The rise in March was the first in six months.

Economists said the surprisingly upbeat data suggests Covid disruptions to factories in late 2022 and early 2023 were more serious than previously estimated, while external demand is holding up better than expected for now.

“It was very surprising indeed,” said Michelle Lam, economist for Greater China at Societe Generale SA. “Much of the rebound was likely driven by easing supply disruptions. Its impact on exports and production was likely far more serious than previously envisaged. Therefore, today’s data seem to suggest the slowdown in external demand is not as concerning as previously thought.”

Stocks in China extended losses in afternoon trading, with the CSI 300 Index falling 0.7% as of 1:30 p.m. local time to underperform Asian peers. The Hang Seng China Enterprises Index of Chinese shares traded in Hong Kong was also down 0.7%, although that was an improvement from a 2.3% decline earlier in the day. The yield on 10-year government bonds rose 2 basis points, set for the first increase in five sessions, while the yuan was little changed.

Slowing Global Outlook

The World Trade Organization said last week that global trade will slump below historical growth trends this year, expanding 1.7% amid geopolitical tensions and economic pressures including inflation, Russia’s invasion of Ukraine, monetary policy tightening and financial market uncertainty. Trade weakness is also being seen in factory sentiment data.

“The export data were a reflection of a rather good phase of the economic cycle,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc. “The challenge will grow in the second half of the year” when the US economy is likely to stagnate and the effects of monetary policy tightening in the US on China’s foreign trade likely increasing, according to Ding.

The rebound in exports was a surprise since indicators earlier this month seemed to suggest the weakness had continued. South Korean exports, a bellwether for global trade, plunged further in March, although that nation’s trade is much more reliant on the electronics industry than China.

A breakdown of exports shows that car sales expanded the fastest in the first quarter, surging 82% in dollar value terms from a year ago. China is poised to become the world’s second-largest exporter passenger vehicles, thanks in part to the government’s push to develop electric vehicles in recent years.

In addition, exports of oil products, steel products as well as suitcases and bags also soared in the first three months of this year.

What Bloomberg’s Economists Say...

“What explains the surprise? The strong March reading could reflect some monthly volatility caused by shifts in demand and capacity to get goods out the door during the Lunar New Year holiday, which fell in January this year. The March performance could reflect catchup — which won’t last. Looking ahead, we see weakening global demand weighing exports, even if companies no longer need to worry about pandemic-related disruptions to production and logistics.”

—- Eric Zhu, economist

See the full report here.

“China’s foreign trade in the first quarter showed relatively strong resilience and came off a stable start to the year with signs of improvement,” Lyu Daliang, a spokesman for the customs office, told reporters in Beijing. However, difficulties and challenges remain due to high global inflation, slowing growth in major economies, rising protectionism and geopolitical risks, he added.

In yuan terms, China’s exports rose about 23% in March from a year ago, up from 5.2% in February, according to Bloomberg calculations based on official data. Imports increased about 6.3% in March after rising 11.1% in February.

--With assistance from Fran Wang, Wenjin Lv and Shikhar Balwani.

(Updates with additional details throughout.)

©2023 Bloomberg L.P.