Mar 10, 2022

China Puts Tough Reforms on Hold to Focus On Growth: NPC Roundup

, Bloomberg News

(Bloomberg) -- China has set an ambitious economic growth target for this year, and is dialing back its tough structural reforms as it shifts toward stimulus.

That’s the takeaway from the weeklong annual session of the National People’s Congress, the Communist Party-controlled parliament, which ends Friday. It’s the the biggest political event before the Party’s congress later this year, when President Xi Jinping is widely expected to extend his term as leader.

Here are some of the key conclusions from the NPC meeting:

Tough GDP Target

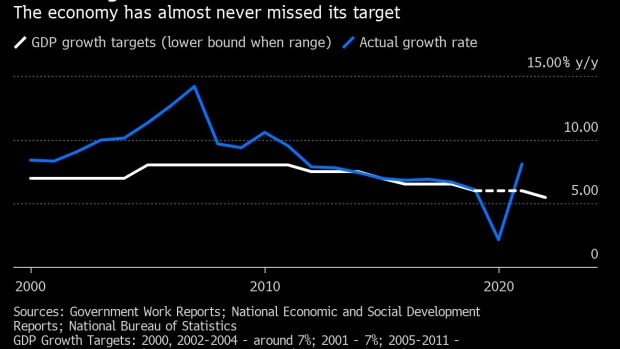

The government’s goal for gross domestic product to expand “about 5.5%” is well above economists’ forecasts for growth, which are closer to 5% this year. The relatively high target is a reflection of political objectives ahead of the Party Congress, with officials making clear that bold measures are needed to stabilize the economy.

“Beijing views maintaining robust economic growth as no longer just an economic issue, but more importantly a political imperative,” analysts at Alpine Macro wrote in a note.

The government’s budget, which is expected to be approved by the NPC on Friday, suggests the main method to boost growth will be fiscal spending on infrastructure projects. After almost zero growth in 2021, HSBC Holdings Plc economists said they expect a rebound in infrastructure investment growth to about 5% this year.

But even before the NPC ends, the growth target is being threatened by several headwinds. Oil prices spiked this week due to sanctions on Russia over its invasion of Ukraine and other commodities such as nickel and wheat also surged.

Read More: China Growth Faces Dual Shocks from Oil Spike and Virus Spread

On top of that, coronavirus cases are climbing to levels not seen since the initial outbreak in Wuhan in 2020, raising the prospect of wider lockdowns. Economists at Goldman Sachs Group Inc. say China will miss its GDP target by as much as 1 percentage point.

Long-Term Goals on Hold

A key reason for the slowdown in the economy last year was Beijing’s attempts to implement difficult structural reforms, which it sees as crucial for long-term growth. In addition to property curbs, a drive for “common prosperity” led to tough regulation of internet and education companies, while tighter pollution controls hit industrial production. Beijing also announced trials for a nationwide property tax to put local government finances on a more sustainable footing.

Yet those reforms hardly got a mention in the government’s work report delivered by Premier Li Keqiang. There was only one reference to “prosperity for all” in the English version of Li’s speech and no mention of a property tax.

And unlike previous years, Beijing didn’t set a target for “energy intensity,” a move that should give policy makers more flexibility to prioritize growth over controlling pollution. Xi also told local officials they should be cautious about reducing emissions.

Read More: China Shuns Energy Use Target to Focus on Securing Fuel Supply

“Growth comes before emission targets as far as 2022 is concerned while maintaining long-term targets intact,” analysts at Natixis SA said in a note. “One can of course wonder how such long-term targets may be maintained down the road if growth still comes first.”

No Property Stimulus

The single biggest drag on the economy last year was plummeting sales in the huge real-estate sector, largely the result of official efforts to limit financing to developers and households to reduce the economy’s reliance on property.

The nation’s top banking regulator Guo Shuqing -- whose remarks about property being the biggest “gray rhino” risk to China’s economy were seen as launching the property crackdown -- said at the NPC that those risks were now under control, signaling policy tightening is over.

But a large stimulus to the sector -- which was the case after previous slumps in 2015 and 2020 -- appears to have been ruled out, with Beijing keeping its language around the property market unchanged.

“As Beijing sticks to ‘housing is for living, not for speculation,’ the property market is unlikely to see a meaningful recovery in the foreseeable future,” Commerzbank AG economists wrote in a note.

Keeping Debt Under Control

Beijing’s message is that it wants to stimulate the economy without a surge in government or corporate debt. To achieve this, fiscal stimulus will rely on saved funds from last year and some unusual measures -- such as using 1 trillion yuan ($158 billion) of profit from foreign exchange earnings from the central bank.

Read More: China’s Government Gets 1 Trillion Yuan Boost From Central Bank

Authorities pledged to keep the growth of credit in line with nominal GDP growth, which will prevent a rebound of the broad debt-to-GDP ratio, according to S&P Global.

The NPC’s discussion of monetary policy “does not suggest a deluge of credit is on the way,” Craig Botham of Pantheon Macroecomics wrote in note.

Covid Zero Stays For Now

Beijing ruled out any rapid change in its policy of trying to keep coronavirus cases as low as possible. But Li suggested that measures will be tweaked to have the smallest possible impact on the economy.

“Local cases must be handled in a scientific and targeted manner, and the normal order of work and life must be ensured,” he told the NPC.

However, last year’s reference to “strict measures” was removed, suggesting that over the year “the government might also loosen its zero-Covid policies,” said Adam Wolfe, an economist at Absolute Strategy Research in London.

©2022 Bloomberg L.P.