Sep 1, 2019

China’s Manufacturing Sector Keeps Getting Whacked by Trump

, Bloomberg News

(Bloomberg) -- The outlook for China’s manufacturing sector deteriorated further in August, underlining the weakness in the domestic economy just as a new round of tariffs kicks in.

The manufacturing purchasing managers’ index dropped to 49.5, according to data released by the National Bureau of Statistics on Saturday, with sub-gauges showing that domestic and new overseas orders contracted. On Sunday, higher U.S. tariffs on roughly $110 billion in Chinese imports took effect, as did Beijing’s retaliatory duties on U.S. goods coming the other way.

U.S President Donald Trump’s tariff war continues to heap pressure on China’s economy and policy makers at a time when economic output is already in a long-term deceleration. Until now, officials have stuck doggedly to a relatively limited roster of stimulus measures out of concern that more ambitious support would further swell indebtedness and over-inflate the frothy property market.

“While we find Beijing’s self-restraint admirable, we are unsure whether this well-intended master plan could be put into practice, as the risks to growth may have been underestimated,” analysts at Nomura International Ltd including Lu Ting wrote in a note. Toward the end of the year the government “may be compelled to increase credit growth and ease its tightening measures on property markets again.”

The government is not sounding the alarm just yet. Late Sunday, the State Council, China’s cabinet, released a statement saying that overall risks are “controllable” and the economy is stable. At the same time, counter-cyclical adjustments in economic policy will be increased, according to the statement.

Export Contraction

The sub-index gauging new export orders rose to 47.2, but was still in contraction, while new orders contracted further. The extra tariffs will now hit manufacturers harder.

A 15% additional U.S. duty hit consumer goods ranging from footwear and apparel to home textiles and certain technology products like the Apple Watch. A separate batch of about $160 billion in Chinese goods -- including laptops and cellphones -- will be hit with 15% tariffs on Dec. 15.

In turn, China targeted U.S. agricultural and manufacturing centers in the Midwest and South, with higher tariffs on soybeans and other farm goods plus the ramping up of charges on U.S. autos -- where duties can now total as much as 50%.

In the PMI report, the index showing prices at the factory door continue to decline, although the renewed contraction of input prices should relieve some of the pressure on company profits.

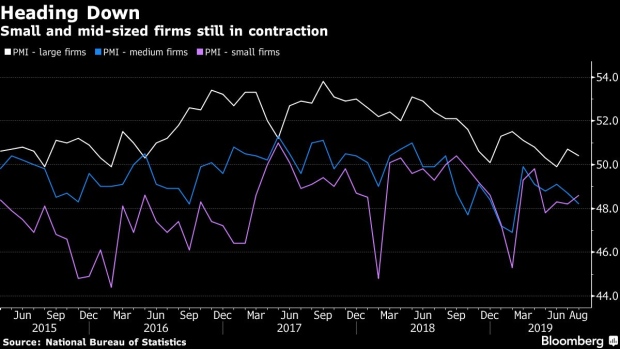

The economy slowed in July and a set of early data collated by Bloomberg showed the trend continuing in August, with poor sales managers’ sentiment and falling trade. However, an improvement in small business confidence is a sign that earlier pro-growth measures may be having an effect.

Small Business Glimmer

Economists continue to warn that the trade war risks dragging the global economy into recession, a development that would ultimately feed through into Chinese domestic demand. For now, officials may take some encouragement from the relative strength of the services and construction PMI index, which rose marginally in August and remains in expansion.

That partly reflects the long-term shift of the economy away from investment and exports and toward a consumption-led growth model.

There are signs that the rapid escalation in the trade war in recent weeks could be topping out. Last week China indicated that it wouldn’t immediately retaliate against the next round of higher U.S. duties. Trump indicated Friday that negotiations between the two nations slated for September are still going ahead.

However with each new downbeat data release, Chinese policy makers face greater pressure to abandon their restrained stimulus approach.

“In a macro environment with a weaker credit cycle and falling nominal growth, there is room and urgency for monetary policy to loosen, in order to prevent real interest rates from rising further,” economists at China International Capital Corp. led by Yuan Yue wrote.

--With assistance from Yinan Zhao.

To contact Bloomberg News staff for this story: Miao Han in Beijing at mhan22@bloomberg.net;Tomoko Sato in Tokyo at tsato3@bloomberg.net

To contact the editors responsible for this story: Jeffrey Black at jblack25@bloomberg.net, James Mayger

©2019 Bloomberg L.P.