Feb 25, 2023

China’s Upcoming Congress Spurs Optimism on Mainland Stocks

, Bloomberg News

(Bloomberg) -- China’s upcoming National People’s Congress is spurring a preference for onshore stocks over their Hong Kong peers as investors expect the former to benefit more from potential pro-growth measures from the political gathering.

The CSI 300 Index of mainland shares is set to outperform a gauge of the nation’s equities traded in Hong Kong this month for the first time since October. Strategists at Morgan Stanley say “now is the right time” to add onshore exposure.

China stock bulls are counting on the NPC starting March 5 to be a fresh catalyst for the market, expecting more stimulus to keep the economy humming. Onshore stocks that mostly cater to domestic customers are seen as key beneficiaries. Their lower correlation to global macro factors such as rising US interest rates also makes them more appealing for investors.

“A-shares are more exposed to consumption and local economy etc, and investors are expecting some catalysts to come out of the NPC,” said Marvin Chen, a Bloomberg Intelligence analyst, referring to mainland traded stocks. Also, as Hong Kong-listed shares are more exposed to global liquidity flows, they tend to underperform when markets are worried about the Federal Reserve’s tightening, he added.

China’s leaders are set to announce economic targets for the year at the NPC after notching just 3% growth in 2022. All eyes are on further measures for consumption stimulus and property sector rescue as boosting domestic demand remains a priority for President Xi Jinping.

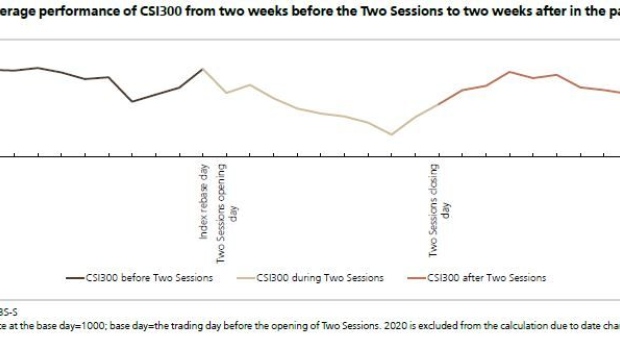

History suggests that the Two Sessions, which comprise of the NPC and a meeting of the top political advisory body, could offer stocks a short-term boost, according to UBS Group AG. Mainland shares have tended to rally ahead of the meetings on policy tailwind hopes and afterward as investors digest signals, but correct in between, strategists including Lei Meng wrote in a Feb. 20 note.

Property and healthcare stocks saw the largest excess returns following the meetings over the past decade, they said. When the gatherings are underway, communication and tech sectors typically received a boost.

‘Further Upside’

The shift in investor preference comes as the reopening euphoria has faded.

The Hang Seng China Enterprises Index, with its heavy tech holdings and relatively higher exposure to foreign flows, tumbled into a correction this month after surging 50% in the three months through Jan. 31. It wiped out this year’s gain on Friday. Meanwhile, the CSI 300 has slid about 2% in February, and is up 4.9% for the year.

“Our conviction that further upside is in sight for China equity markets, including the A share market, remain intact,” Morgan Stanley strategists led by Laura Wang wrote in a Feb. 17 note.

While bullish sentiment on the broader Chinese and Hong Kong stocks remains relatively intact, tensions with the US and worries that China’s growth may fail to impress are keeping some investors on the sidelines.

To be sure, lofty expectations also mean NPC disappointments may spark a selloff, as seen during an October party congress when Xi’s renewed grip spooked the market. Still, Goldman Sachs Group Inc.’s Timothy Moe expects the onshore market to prove more resilient in the event of a selloff.

There has been “a bit of profit taking from some of the early money” in the Hong Kong market, Moe, chief Asia-Pacific equity strategist at Goldman Sachs, said at a recent press briefing. “If we’re a little bit worried about potential weakness in this equity market, that China A is arguably the place that would be most resilient to that.”

©2023 Bloomberg L.P.