Sep 4, 2023

China Services Activity Eases in Knock to Recovery, Survey Shows

, Bloomberg News

(Bloomberg) -- A private survey of China’s services sector showed activity expanded at the slowest rate this year in August, as the economy’s darkened outlook and ongoing property turmoil hold people back from spending.

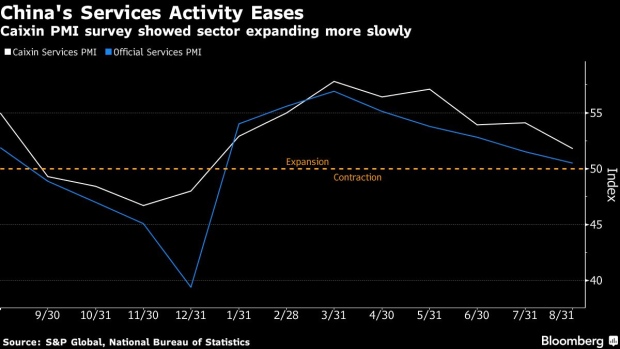

The Caixin services purchasing managers’ index fell to 51.8 last month from 54.1 in July, Caixin and S&P Global said in a statement Tuesday. While the reading was still above the 50 line that separates expansion from contraction, it was the weakest pace since December.

The dropoff was mainly because of a softer increase in overall new work, with new business from abroad falling for the first time this year, according to a statement accompanying the survey. The survey also covers real estate activities, a sector that has been one of the biggest drags this year.

“The recovery in China’s services sector, or even consumption, is ongoing but not as strong as people had expected,” said Larry Hu, head of China economists at Macquarie Group Ltd. “People are not very optimistic about their future income due to the economic woes, and so they tend to save more.”

A gauge of Chinese stocks in Hong Kong fell 1.5% as of the mid-day break, while the mainland’s CSI 300 Index was down 0.6%. The yuan extended loss in both onshore and overseas trading after the data release, while the Australian dollar, which is risk-sensitive and seen as a proxy for China, weakened as much as 0.7%.

The data came after official PMIs last week showed services activity easing significantly last month: The sub-index’s 50.5 reading was the weakest since December. The Caixin survey focuses on smaller firms compared to the official PMI, with the latter also having a larger sample size.

The weakness in both the official and private services PMIs were due “potentially” to a “combination of fading reopening boost, weakening property market and sluggish external demand,” according to economists at Goldman Sachs Group Inc.

“We are near the end of the reopening recovery in the service sector,” said Michelle Lam, Greater China economist at Societe Generale SA. She added she wasn’t “too worried” at this stage, given other positive indicators for the consumer services recovery such as domestic travel and movie ticket sales.

One big question is whether the latest measures for the property sector — a big drag on sentiment and activity this year — will be enough to stabilize sentiment, Lam said.

While the recovery remains precarious, recent surveys have showed some improvement for factories. That’s triggered cautious optimism that government policies to support the manufacturing sector are taking root and helping those firms find a bottom to their slump.

The longer-term outlook remains under strain because of waning confidence. In a new report released this week, Bloomberg Economics found China may never consistently overtake the US as the world’s No. 1 economy.

--With assistance from Zhu Lin and Iris Ouyang.

(Updates with details about the property sector.)

©2023 Bloomberg L.P.