Feb 3, 2021

Chinese Offshore Bond Defaults Reach Nearly 33% of 2020’s Total

, Bloomberg News

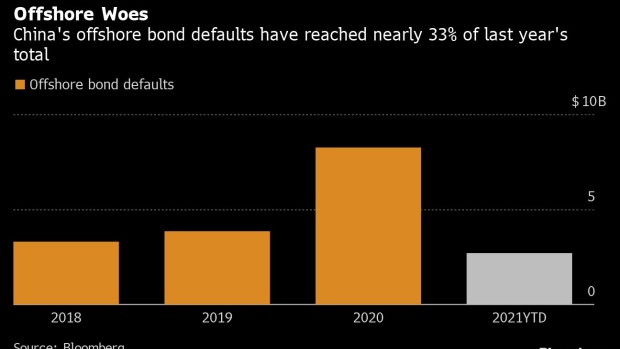

(Bloomberg) -- Stress is building up in China’s offshore bond market again, with defaults so far this year already amounting to one third of 2020’s total.

Chinese firms have missed interest or principal payments on a combined $2.7 billion worth of dollar notes since the year began, nearly 33% of last year’s tally and 70% of 2019’s total, data compiled by Bloomberg show. The latest offshore debt blowups came from firms including a unit of solar giant GCL-Poly Energy Holdings Ltd. and tech conglomerate Tsinghua Unigroup Co..

Defaults among Chinese borrowers are likely to increase this year, according to Cecilia Chan, a Bloomberg Intelligence analyst. “Despite the government’s implementation of top-down policy easing, companies have limited access to refinance their capital, which may worsen if the government looks to tighten monetary policy after a recovery in economic growth.“

©2021 Bloomberg L.P.