Mar 13, 2024

CIBC sees Government of Canada bond issuance rising 22%

, Bloomberg News

Buy these 3 corporate bonds as markets await rate cuts: Earl Davis

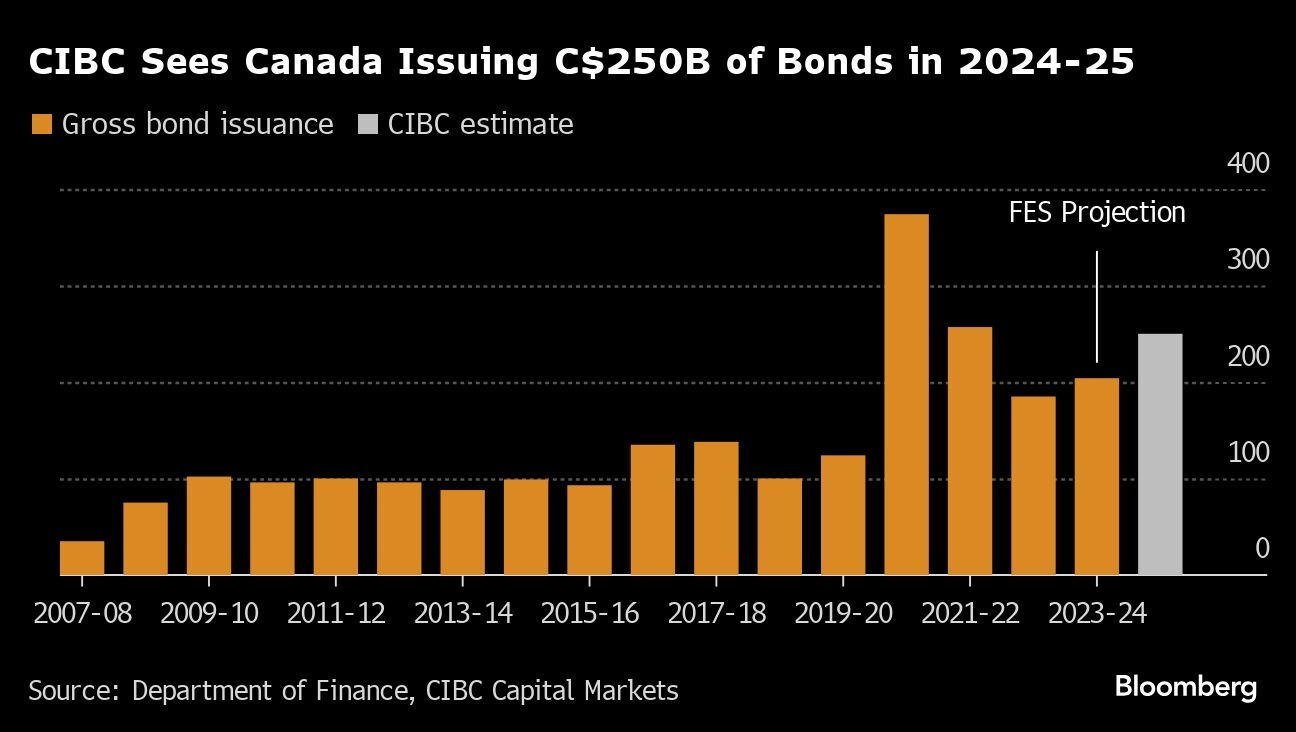

Justin Trudeau’s government will end up tapping the bond market for around $250 billion in debt next year, one of the country’s biggest lenders says.

Canadian Imperial Bank of Commerce says a combination of refinancing needs, the budget balance and non-budget items totals $265 billion, but the Finance Department has already pre-funded about $13 billion. This reduces CIBC’s bond issuance estimate for the 2024-25 fiscal year to about a quarter-trillion dollars.

Finance Minister Chrystia Freeland is set to introduce her government’s budget on April 16.

By CIBC’s estimates, the 22 per cent increase in gross bond debt from the current year represents the single largest issuance excluding 2020-21 and 2021-22, when Canada’s government spent billions and racked up record deficits during the pandemic, analysts Ian Pollick, Sarah Ying and Arjun Ananth wrote in a report to investors.

“Bond issuance is rising at a historic pace. When the sovereign is abundant with debt, investors need to rethink their allocation strategies,” Pollick said in an email.

“A lack of progress on disinflation and growth in bond supply are creating big headwinds for fixed income investors.”

The issuance will partly fund financial requirements for the coming years. The government plans a $38.4 billion deficit for the 2024-25 fiscal year, as estimated in a budget update last November. Freeland has pledged “fiscal restraint,” saying she plans to keep the deficit from rising above that level.

Nearly a third of the $156 billion in maturities coming due in fiscal year 2024-25 were issued during the pandemic at much lower yields, Pollick says. That risks adding to already rising interest burdens.

Canada’s provinces are also issuing more debt as they’re expected to run deficits that are deeper than previously forecast. On Tuesday, the Quebec government projected financing needs for the coming year are $36.5 billion, a 70 per cent increase from the current year.

“In aggregate, the worsening of provincial deficits coupled with federal issuance may create a ‘crowding out’ effect in the Canadian bond market,” Pollick said.

Some of the increased issuance will fund purchases of Canada Mortgage Bonds, the analysts said. In November, the government announced it would purchase as much as $30 billion in mortgage bonds.

Higher-than-expected interest costs and limited progress on reducing operating expenses have raised concerns from business groups that the Liberals will turn to corporate taxes in their bid to achieve their fiscal goals.