Feb 15, 2024

Coinbase Rises After JPMorgan Analyst Ditches Short-Lived Bear Call

, Bloomberg News

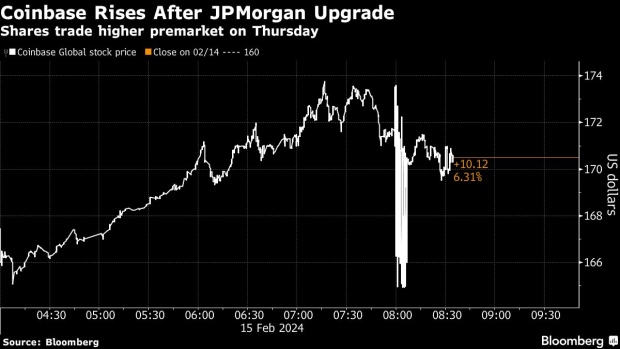

(Bloomberg) -- Coinbase Global Inc. gained Thursday as a JPMorgan analyst ditched his bearish view just weeks after downgrading the stock.

Shares gained as much as 7.8% following the upgrade as Bitcoin traded higher. The biggest US cryptocurrency exchange is likely to see a boon from the recent rally in digital asset prices, analyst Kenneth Worthington said as he shifted his rating back to neutral.

His call follows close on the heels of his January downgrade to underweight where he predicted the enthusiasm for Bitcoin ETFs could “deflate.” Instead, the funds have been successful on key trading measures and Bitcoin’s price has surged past $52,000 to hit the highest mark since 2021.

“Given the acceleration in recent days of flows into Bitcoin ETFs and the significant price appreciation of Bitcoin and now Ethereum, we are returning to a Neutral rating on Coinbase as we see the higher cryptocurrency prices not only sustaining, but improving, activity levels and Coinbase’s earnings power as we look to 1Q24,” the analyst wrote in a note to clients Thursday.

Coinbase’s stock had dipped nearly 8% to start the year through Wednesday’s close, after shares surged by nearly 400% in 2023.

Wall Street remains divided on the stock: Analysts are roughly evenly split between buy, hold and sell recommendations. Worthington maintained his $80 price target on the stock ahead of the company’s earnings report, which is expected after market close on Thursday.

Read More: Coinbase May Surprise Wall Street by Returning to Profitability

“Coinbase’s business is geared towards higher token prices,” Worthington wrote. “The core revenue is transaction-based and given fees are driven off value traded, the higher value and higher velocity that accompanies the higher token prices should drive trading volume higher.”

--With assistance from Henry Ren.

(Updates shares and chart for regular hours trading.)

©2024 Bloomberg L.P.