Nov 11, 2022

Crypto Contagion Seen Contained as Speculative Stocks Fringe Soars

, Bloomberg News

(Bloomberg) -- Investors worried that the cryptosphere’s meltdown will spread to the broader stock market got some reassurance as the speculative fringe of the equities universe surged anew.

A basket of unprofitable tech firms added nearly 10% at one point Friday and Cathie Wood’s ARK Innovation ETF (ticker ARKK), widely seen as a symbol of retail traders’ appetite, jumped roughly the same magnitude. The advances came even as Bitcoin fell as much as 8%. The largest coin by market value sank to around $15,500 this week, its lowest since 2020. Other cryptocurrencies, from Ether to Solana, also plunged amid the collapse of Sam Bankman-Fried’s digital-asset empire.

The overarching concern was that burnt investors would dump their riskiest stock holdings and flee to safer bets such as passive indexes. However, the resilience of these speculative assets proved a source of comfort as these wagers on future growth soared during the equity market’s best week in months.

“That ARKK is up and Bitcoin is down is a tell that the contagion is pretty limited,” said Michael Purves, founder of Tallbacken Capital Advisors. “There are probably some time bombs lurking on some companies’ balance sheets, but I think those are probably idiosyncratic events.”

The downfall of Bankman-Fried’s FTX.com has caused widespread angst in the crypto space. Investors have been left to assess the full extent of the collateral damage from one of the industry’s highest-profile firms, especially after his empire filed for bankruptcy Friday.

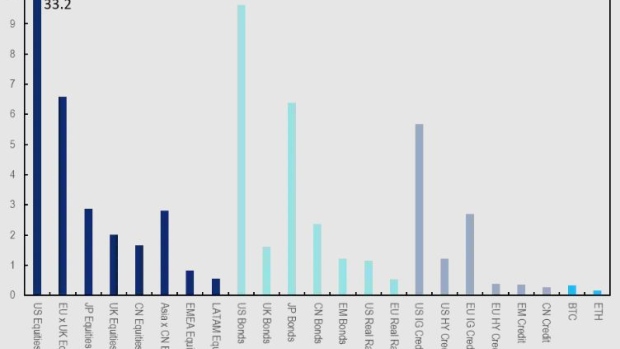

For Citigroup Inc. strategists led by Joseph Ayoub, the crypto market just isn’t big enough to threaten other asset classes.

“Cryptocurrency markets remain too small and too siloed to cause contagion in financial markets, with an $890bn market cap in comparison to US equity’s $41tn,” they wrote in a note Friday.

The potential black hole in FTX’s financial reporting and accounting remains largely unknown. But the Citigroup strategists point to other crypto firms that collapsed, such as Luna, which saw an estimated $60 billion loss, as well as the technology sector’s 2022 drawdown, which saw megacap firms shed around $477 billion in combined market value. If anything, it’s the cash FTX raised from venture capital and venture funds whose effects may prove most painful, they said.

“This is the primary way financial markets could suffer, as it may have further minor implications for portfolio shocks in a volatile macro regime,” the strategists said.

As the cryptocurrency industry faces what could be the toughest phase yet in its 14-year history, the current slump is drawing comparisons to other times of severe market stress, such as the collapse of Lehman Brothers.

Matt Maley at Miller Tabak + Co., for one, doesn’t see the validity of that line of thought.

“I don’t see it being anything close to what we saw when Lehman went under,” said Maley, the firm’s chief market strategist. “However, it does show that there are still a lot of assets that are overvalued and overleveraged. Therefore, I do think it will still have a negative impact on the stock market before long.”

©2022 Bloomberg L.P.