Mar 30, 2023

Currency Plunge Pushes Zambia Inflation to Three-Month High

, Bloomberg News

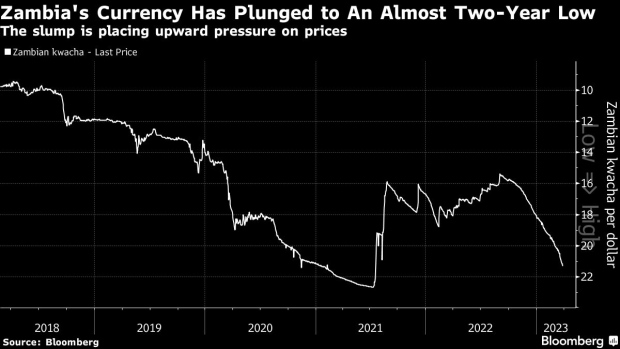

(Bloomberg) -- Zambian inflation quickened to a three-month high in March as a slide in the currency, largely driven by the country’s stalled debt restructuring talks, pushed up the price of imports such as gasoline and cereals.

Annual consumer-price growth accelerated to 9.9%, from 9.6% in February, Statistician-General Mulenga Musepa told reporters Thursday in Lusaka, the capital. Inflation has been above the central bank’s 6% to 8% target range since April 2019.

The main reason is the unremitting decline in the kwacha, which has fallen about 18% versus the dollar already this year, as talks to restructure $12.8 billion in debt have dragged on. Zambia is about to miss its target to strike a deal with creditors by the end of March, a key step in the government’s efforts to rework debt.

The kwacha is on track for its biggest quarterly slide since early 2020, when investors sold off the kwacha over fears of Zambia becoming Africa’s first pandemic-era sovereign defaulter. The country defaulted in November that year.

Zambia’s President Hakainde Hichilema has underscored the urgent need to strike a deal. “Prices are once again creeping up, and much-needed international investment is blocked,” he wrote in a March 28 opinion piece.

Read more: ‘You Cannot Eat Democracy’: Hakainde Hichilema

There are further upside risks to inflation, with the state power utility planning to raise electricity tariffs by 37% and corn output could drop because of adverse weather conditions and fall armyworms infestations

Food inflation accelerated to 11.8% from 11.6% last month and non-food inflation quickened to 7.3% from 6.9% in February. Prices rose 1% in the month from 1.9% in February.

The central bank last month raised interest rates by a quarter point and increased commercial lenders’ reserve ratios to 11.5% from 9%. But that has failed to steady the kwacha, and analysts expect another rate hike in May.

(Adds details on debt talks and decline in kwacha in third and fourth paragraph.)

©2023 Bloomberg L.P.