Mar 3, 2022

Eastern Europe Taps $430 Billion Reserve to Shield Currencies

, Bloomberg News

(Bloomberg) -- Some East European nations are dipping into their international reserves to prop up currencies hit by the fallout from Russia’s invasion of Ukraine.

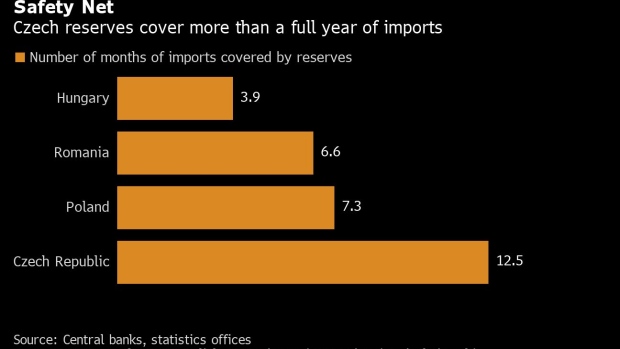

Boosted by years of European Union transfers and strong growth, the region’s four biggest economies have amassed foreign reserves totaling roughly $430 billion. All have stockpiles large enough to cover three months’ worth of imports -- in line with international recommendations -- led by the Czech Republic, which has reserves that would last for more than a year.

ING Groep NV said the size of each country’s reserves has helped shape policy responses. Hungary, whose stockpile is relatively smaller, opted for a bigger-than-expected interest rate increase on Thursday. Poland -- with reserves equal to seven months of imports -- sold foreign currency on the market.

Countries will seek to avoid “major” interventions, which could sharply eat into their reserves and increase “external vulnerability in an already uncertain global environment,” ING analysts, including Rafal Benecki, wrote.

Since Russia’s invasion of Ukraine on Feb. 24, only the ruble has depreciated more than the Hungary’s forint, the Czech koruna and Poland’s zloty among the 31 major currencies tracked by Bloomberg. Romania’s leu is closely managed by the central bank, which regularly intervenes on the market but doesn’t comment about its activities or specific currency levels.

The Czech reserve pile, which central bankers in Prague themselves called “enormous,” is a legacy of its Swiss-style currency cap from the last decade, when policy makers tried to keep the koruna weak by selling the local currency on the market.

Policy maker Tomas Holub said this week that koruna moves so far didn’t warrant interventions. The central bank is now more sensitive to currency moves, he added, because of high inflation, and will step in if it sees excessive depreciation pressures.

©2022 Bloomberg L.P.