Jan 31, 2017

U.S. dollar tumbles after Trump adviser Navarro calls euro 'grossly undervalued'

, Reuters

The dollar tumbled on Tuesday, headed for its worst start to a year in over a decade, while stocks cemented their biggest losses in six weeks as U.S. President Donald Trump added uncertainty to the market following stringent curbs on travel to the United States.

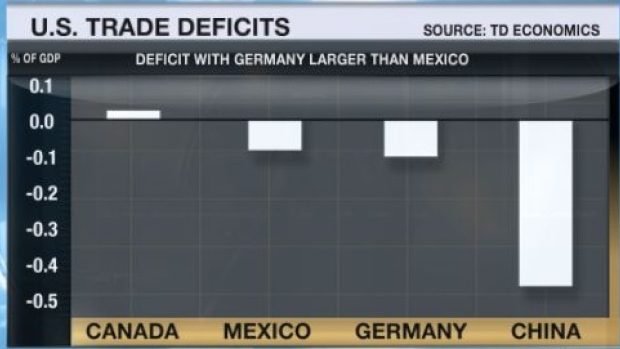

Comments from Trump's top trade adviser, Peter Navarro, that Germany was using a "grossly undervalued" euro to gain advantage over the U.S. knocked the dollar in early North American trading.

Trump followed up on those comments in a meeting with the chief executives of several top drugmakers, during which he said drug companies had outsourced production because of currency devaluation by other countries.

That dragged the dollar index, which tracks the greenback against six rival currencies, to its lowest since Dec. 8. The index is down 2.6 for the month, on pace for its worst January since 2006.

"You don't talk about levels, don't really talk about valuation and you certainly don't talk about other people's currencies," said Greg Anderson, Global head of FX strategy for BMO Capital Markets in New York. "You can maybe make a comment or two about your own but you don't talk about others'."

Anderson also noted that Navarro isn’t Treasury secretary and the Treasury secretary is usually the spokesperson for currency.

"This hasn't been done before. It's maybe a little unsettling for the market," he said.

Investors' hopes for a fiscal boost to the world's largest economy under Trump have been tempered by controversial and protectionist policies that have seen him suspend travel to the United States from seven Muslim-majority countries.

Wall Street, already lower on weak earnings reports, sunk further after Trump's meeting in which he called on the pharmaceutical industry to boost their U.S. production and lower their prices.

The selling comes a day after Wall Street recorded its worst day of 2017.

"You've got a very busy week for earnings, economic data and central bank meetings," said Adam Sarhan, chief executive officer at 50 Park Investments in Florida.

"So when you add all this political uncertainty, that leads investors to sell stocks first and ask questions later, especially after a historic run."