Apr 9, 2024

European Defense Stocks Sink in Breather from Two-Year Rally

, Bloomberg News

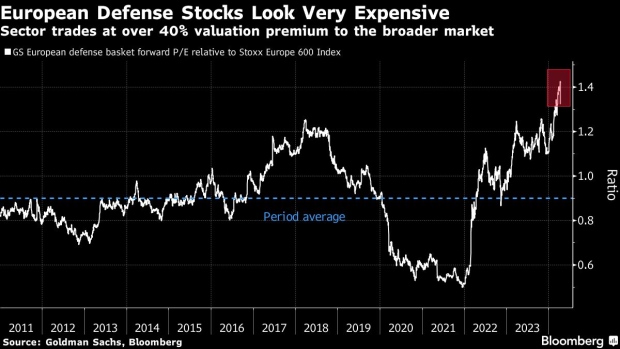

(Bloomberg) -- European defense stocks fell heavily on Tuesday for their worst day in almost 18 months after Goldman Sachs analysts cautioned that the sector’s recent scorching rally had left it trading at elevated price valuations.

Goldman analyst Victor Allard said shares in firms such as Rheinmetall AG, BAE Systems and Saab AB are now at “peak multiples” compared to history, raising the question of whether they have any further upside. On Tuesday, a defense shares index compiled by Goldman, slid much as 7.5%, the most since November 2022, impacted also by the possibility of a Gaza cease fire.

But the index’s setback looks minor in the context of its 42% surge so far in 2024, which came on top of a 39% gain last year and a 54% rise in 2022. Investors have piled into the sector on expectation that European governments will embark on a military spending spree to counter the threat from an increasingly belligerent Russia. Conflicts in the Middle East have added to the impetus.

Allard pointed out that defense stocks trade now at nearly 20 times forward earnings, a record 45% premium to the Stoxx Europe 600 benchmark. Historically, they have traded at a 10% discount, he said.

At such valuations, the shares “present more downside than upside risk,” he told clients in a note.

While Europe’s defense industry has been on a roll since Russia’s February 2022 invasion of Ukraine, one of the biggest beneficiaries has been Germany’s Rheinmetall. Its shares have gained about 380% since then.

On Tuesday, they slumped 12%, the most since August 2022. Italy’s Leonardo SpA dropped as much as 9.3% while BAE Systems Plc shed 6%.

Bernstein analysts said European defense firms’ earnings growth is expected to outpace US rivals this year and in 2025. They noted however, that having languished at a 50% valuation discount versus the US in early 2022, Europe has now closed that gap.

--With assistance from Michael Msika.

©2024 Bloomberg L.P.