Nov 19, 2018

FAANG stocks are getting knocked again

, Bloomberg News

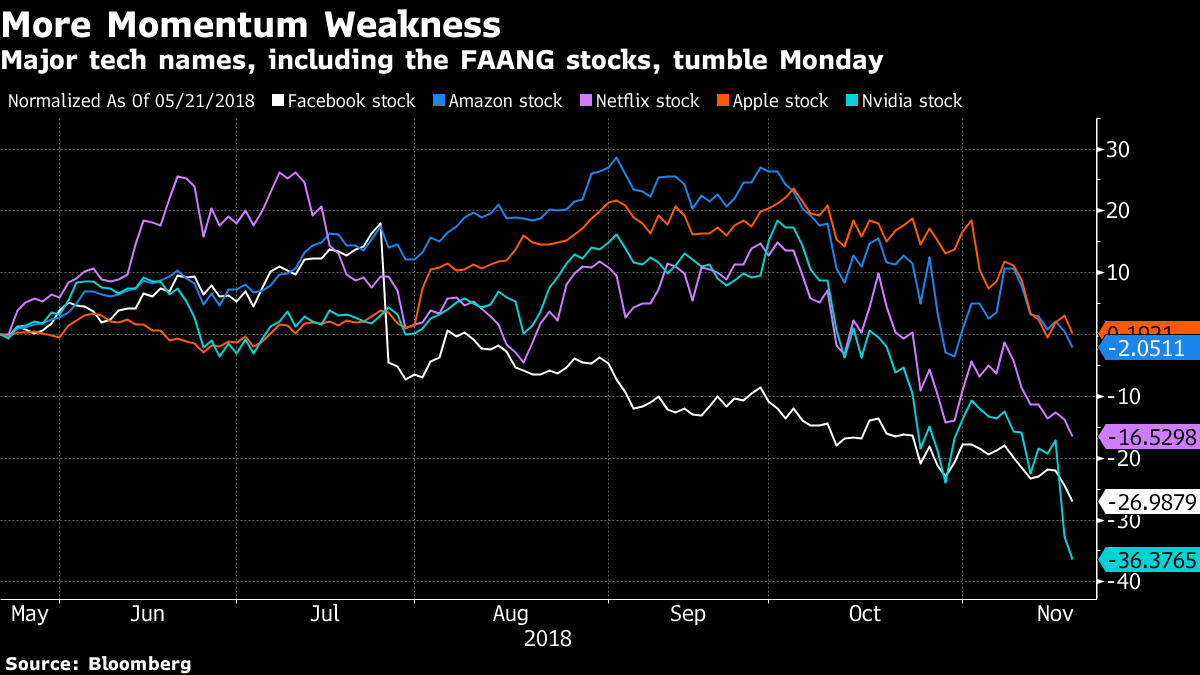

The biggest stocks in technology and the Internet resumed their descent Monday after a brief respite late last week, the latest example of heavy volatility hitting the sector as investors continue to fret that the one-time market darlings suddenly face a darker outlook for growth.

The so-called FAANG stocks were among the biggest decliners of the day. Facebook Inc. (FB.O) fell as much as 4.4 per cent to the lowest since February 2017, while Netflix Inc. (NFLX.O) shed 4.7 per cent intraday and Amazon.com Inc. (AMZN.O) was off as much as 3.8 per cent.

Apple Inc. (AAPL.O), the largest stock in the market, fell 3.4 per cent at its lowest, and was on track for its sixth decline in the past eight sessions. The Dow component has come under heavy pressure lately, dropping about 20 per cent from an early October record, on mounting concern for the future iPhone demand. On Monday, the Wall Street Journal reported that Apple recently cut production orders for all three of the iPhone models that it unveiled in September.

Semiconductor stocks also extended their recent weakness. Nvidia Inc. tumbled as much as 8.4 per cent, adding to Friday’s 19 per cent slump in the aftermath of a weak outlook. The stock has shed nearly half its value since early October.

Among other chipmakers, Advanced Micro Devices fell 6.2 per cent intraday while Micron Technology fell 4.1 per cent at the low. Micron was pressured after the Financial Times reported that Chinese authorities would deepen an antitrust probe into Micron and two other chipmakers, claiming ”massive evidence” of violations.