Jan 19, 2024

Global Investors Sell Record Amount of Colombia Peso Bonds After 30% Rally

, Bloomberg News

(Bloomberg) -- Global investors dumped Colombia local government bonds at a record pace last year, setting up a pivotal test for the government’s ability to keep attracting foreign money.

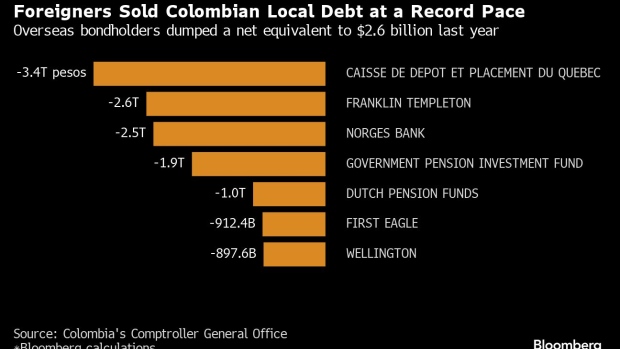

Franklin Templeton, Canadian pension fund Caisse de Depot et Placement du Quebec and Norway’s sovereign wealth fund reduced their holdings while Japan’s Government Pension Investment Fund liquidated its position. All told, foreigners were net sellers of $2.6 billion of the so-called TES notes, the most since at least 2010 when records began, according to data from the Comptroller General Office.

The selloff — which came even as the debt posted some of the best returns in emerging markets — left foreign investors holding about 21% of the $125 billion market as of the end of last year, the lowest level since 2016, the data show.

Money managers have targeted local government bonds as a top trade in emerging markets this year as inflation slows but interest rates remain high. The question for buyers of Colombia debt is how quickly the country’s central bank can control prices — inflation is running at 9.3% — compared to other countries.

“Inflation is still quite high, and will probably converge to target more slowly than in other Latam countries, which is why it’s not among our top picks in local-currency bonds,” said Carlos de Sousa, portfolio manager at Vontobel Asset Management AG. “Valuations are no longer that attractive” compared to 2023, he said.

Adding to risks, S&P Global Ratings on Thursday lowered Colombia’s outlook to negative from stable, citing the risk of a prolonged period of weak economic growth. It maintained its BB+ rating, which is one notch below investment grade.

Others see last year’s rally spilling over into 2024.

Colombian local bonds returned 30% last year, compared to an average gain of 10% across an index of local-currency government debt. The peso strengthened 26% last year, the most among all major currencies tracked by Bloomberg.

The returns attracted managers of BlackRock Inc. Strategic Income Opportunities Fund, the Kuwait Investment Authority and Vanguard Group Inc., all of which were net buyers.

Local pension funds amassed $8.6 billion and now own a third of the total amount outstanding, helping to offset the outflows from foreigners.

“We like local bonds in Colombia and think they will perform well relative to regional peers this year,” Lewis Jones, a portfolio manager at William Blair said. “We expect steady disinflation to continue, which should benefit bondholders.”

More Gains

Colombia was one of the last nations in Latin America to kick off an easing cycle, lowering its benchmark rate by a quarter point to 13% last month, which is still the highest among regional peers.

Economists surveyed by the central bank expect interest rate cuts of 4.75 percentage points this year to 8.25% by December. Inflation is forecast to come down to 5.4% by the end of the year.

TES notes are poised to gain as the central bank continues to ease rates, according to Munir Jalil, chief economist for the Andean region at BTG.

“Last year’s gains were driven by high interest rates and the carry, while these gains will come from the valuation of assets,” Jalil said.

--With assistance from Zijia Song.

©2024 Bloomberg L.P.