Aug 5, 2020

Gold barrels past US$2,000 with stage set for prices to rally more

, Bloomberg News

Brian Madden discusses the price of gold

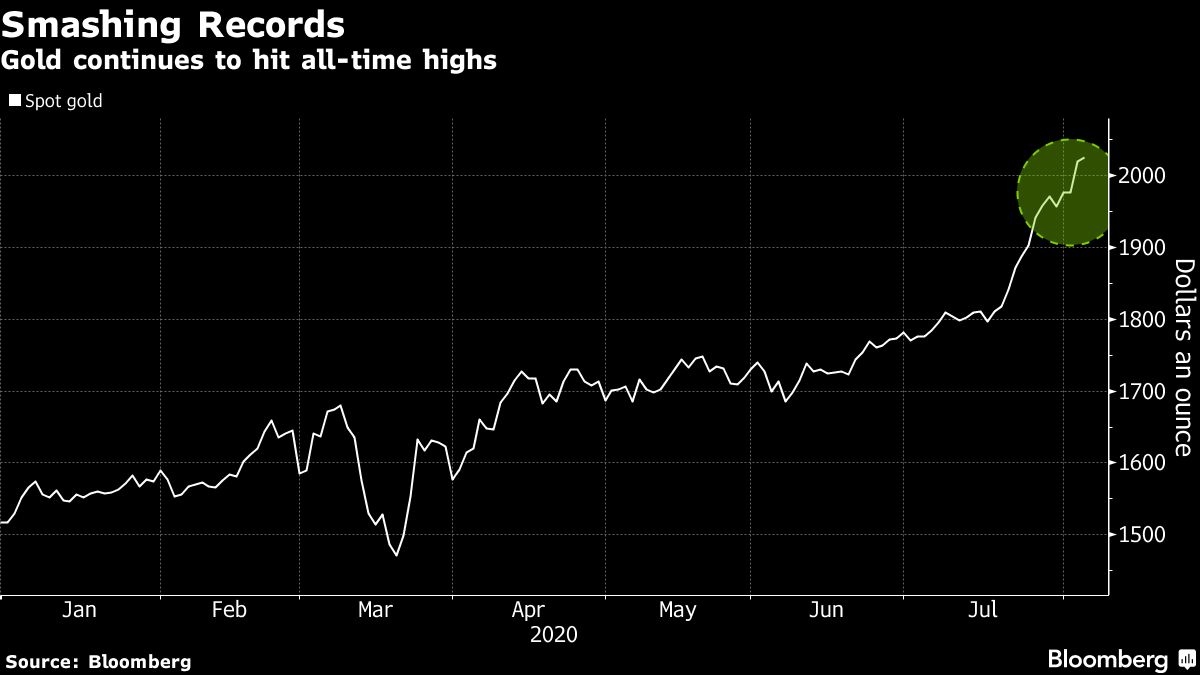

Gold advanced to a fresh record beyond US$2,000 an ounce as investors assessed increased geopolitical risks and the prospect for further stimulus to combat fallout from the coronavirus pandemic.

Bullion is up almost 35 per cent this year, with its haven status enhanced by sliding U.S. real yields. Gold could extend gains as governments and central banks respond to slowing growth with vast amounts of stimulus. The metal’s appeal is strengthening as the dollar weakens and a long global recovery looms. Goldman Sachs Group Inc. forecasts a rally to US$2,300.

“The stage has been set for gold to continue to climb higher,” Paul Wong, market strategist at Sprott Inc., said in a report. “We see increased fiscal spending ahead, extremely accommodative monetary policy in place for years and a challenging economic recovery.”

U.S. Treasury Secretary Steven Mnuchin said the White House and Democrats aim to strike a deal on virus-relief legislation this week, even though the two sides remain far apart on some issues. Federal Reserve Bank of San Francisco President Mary Daly said Tuesday the U.S. economy needs more support than originally thought.

Spot gold rose as much as 1.8 per cent to a record US$2,055.79 an ounce and traded at US$2,036.61 as of 2:06 p.m. in New York. Comex gold futures for December delivery rose 1.4 per cent to settle at US$2,049.30, a record for a most-active contract. Spot silver climbed as much as 4.4 per cent to US$27.1395 an ounce, the highest since April 2013. The Bloomberg Dollar Spot Index slipped 0.5 per cent.

The precious-metal rally comes in spite of economic data showing activity in the euro zone is recovering well, with output expanding for the first time since coronavirus lockdowns hit the economy in March.

Friday will bring an update of the U.S. labor market, with economists expecting unemployment to decline to 10.5 per cent. Even if the data shows some recovery, it will likely still signal greater inflation expectations so long as the Federal Reserve leaves its target rate near zero, which would be positive for gold, Carsten Fritsch, commodity analyst at Commerzbank AG, said by phone.

Shifts in the U.S. bond market have helped underpin gold’s ascent. Real yields on 10-year Treasuries have collapsed below zero. Still, on CPI-adjusted measures they remain above levels seen during previous gold-price peaks, said Adrian Ash, head of research at BullionVault. That means gold could go “a long way higher than US$2,000 per ounce,” he said.

Meanwhile, U.S. and Chinese officials plan to assess the nations’ trade accord this month against a backdrop of rising tensions between the countries, according to people briefed on the matter. The latest tension “adds to an extensive laundry list of concerns that are sending investors toward safe-haven assets,” Stephen Innes, chief global markets strategist at AxiCorp, said in an emailed note. Gold’s “momentum is strong, likely coupled with some short covering.”

The surge in gold does pose risks for a correction, with two major technical indicators suggesting the precious metal was already overbought before it broke through US$2,000.

“Since gold is heavily overbought, there’s clearly risk of some profit-taking at some point,” Commerzbank’s Fritsch said.

In other markets, platinum October futures closed at the highest since February on the New York Mercantile Exchange, while palladium also rose.

Holdings in gold-backed exchange-traded funds increased for a 28th straight day Tuesday, the longest streak since June.