Aug 29, 2021

Huarong Posts $15.9 Billion Loss in 2020, Flags Asset Sales

, Bloomberg News

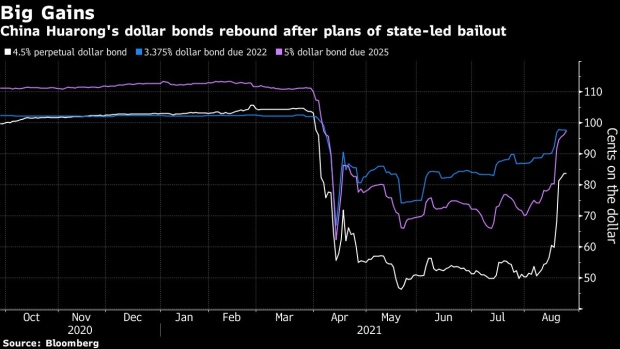

(Bloomberg) -- China Huarong Asset Management Co. confirmed a record loss for 2020 in a long overdue earnings report and flagged a small profit for the first six months of this year, just a little more than a week after it secured a government-orchestrated bailout to keep it from the precipice.

The shortfall was 102.9 billion yuan ($15.9 billion) for all of last year and the profit was 158 million yuan in the first half of this year, the firm said in filings on Sunday in Hong Kong. Huarong booked 107 billion yuan in impairments for 2020 and had a 12.5 billion yuan loss on financial assets. Its key capital level was far below regulatory requirements as of June.

After five months of turmoil since it delayed its earnings report in March, China’s biggest bad debt manager this month secured a rescue package from some of the nation’s biggest financial firms. Its plight had become the biggest test in decades of whether Beijing would still shield state-owned firms from market forces amid a renewed push by President Xi Jinping to rein in debt growth as defaults have hit records.

The firm said on Sunday that it plans to dispose of subsidiaries with non-core business activities in the near future to increase internally generated fund inflows and to replenish capital. It didn’t give any further details on its rescue plan in the report.

State-owned investors including Citic Group, China Insurance Investment Co. and China Life Asset Management Co. on August 18 agreed to put fresh capital in Huarong. The firm would receive $7.7 billion as part of an overhaul plan with control shifting to Citic from the Finance Ministry, though details were still being finalized and could change, people familiar with the matter have said.

Huarong has $243 billion in different liabilities -- including more than $20 billion of offshore bonds -- and has drawn close scrutiny from investors across the world.

Its capital adequacy ratio was 6.32% as of June 30, falling from from 13.2% at the end of June last year. Chinese regulators demand a minimum 12.5% for bad loan asset managers, and at least a 9% core tier-1 ratio.

Moody’s Investors Service last week cut Huarong’s credit rating and put it on watch for a potential further downgrade, citing deterioration of its capital and profitability. The projected 2020 loss “could result in a failure to comply with the minimum regulatory requirements on capital adequacy and leverage, and indicate that the company cannot sustain its operation without support arranged by the government.”

©2021 Bloomberg L.P.