Nov 14, 2023

Investors Are Covering Their Short Bets, Sending Stocks Higher

, Bloomberg News

(Bloomberg) -- US stocks rallied after a surprisingly tame reading on inflation. The surge became the biggest since May thanks to bearish bets gone wrong.

Goldman Sachs Group Inc.’s basket of the most-shorted stocks, which includes names like Beyond Meat Inc. and Maxeon Solar Technologies Ltd., soared as much as 6.8% during the session before paring some of the gains and is still handily beating the the S&P 500 Index’s 2% rise. That gap indicates some investors are preparing to cover short bets, which tends to push stocks higher, according to Chris Murphy, co-head of derivatives strategy at Susquehanna International Group.

“There’s panic to cover shorts alongside this move,” Murphy said. “Once those shorts have mostly been covered, then it may be a sign that a rally will peter out.”

Optimism has been building on bets that interest rates are peaking and the Federal Reserve is done raising interest rates. The S&P 500 has gained 9% in the past 12 sessions, with investors shrugging of the Middle East conflict and the risk of a US government shutdown.

The rebound has been swift as it’s been broad: the NYFANG+ Index of high-flyers like Microsoft Corp. and Tesla Inc. is on track for its best November ever, while money-losing tech firms are up 11% so far this month. The Russell 2000 Index is having its best day in a year.

“The fear of missing out is very powerful,” Quincy Krosby, chief global strategist at LPL Financial, said by phone. “Inflation is coming down, and markets are clearly celebrating that. At the same time, the battle against inflation is far from being over. The markets are still asking, ‘Is this going to be consistent?’”

Investors are growing increasingly comfortable with risk, pushing short sellers to buy back stocks to cover their bearish positions. Goldman’s basket of most shorted stocks is coming off a dismal performance over the past three months, as a strategy of buying stocks that shorts would take the longest to cover posted a 40% loss, wiping out the rally it had clocked from January to July, Bloomberg data show.

Bull Season

Seasonal indicators have turned bullish in November after a bearish three months. Historically, November is the strongest month for stocks and the start of both the strongest two- and six-month periods, data compiled by LPL Financial going back to 1950 show.

But there are points of weakness in November that are approaching. The market tends to drift sideways through the middle of the month and into the US Thanksgiving holiday before rallying to finish the month, according to Jeffrey Hirsch, editor of the Stock Trader’s Almanac.

Bulls need that momentum to show up and continue into year-end. While a JPMorgan survey showed that 36% of its clients plan to increase equity exposure, nearly 70% are less inclined to be long the so-called Magnificent Seven technology companies — Apple Inc., Alphabet Inc., Amazon.com Inc., Meta Platforms Inc., Microsoft, Nvidia Corp. and Tesla. That’s because most of the group’s outlook for fourth-quarter profits and sales has dimmed.

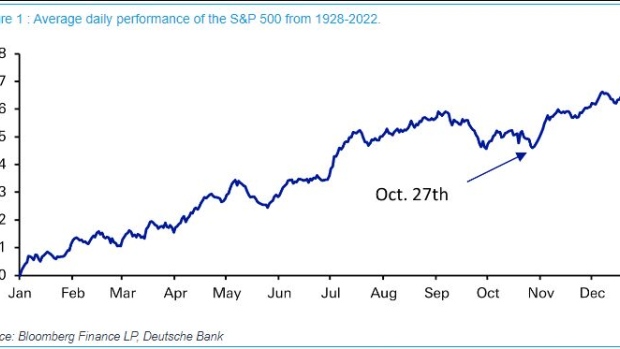

The S&P 500 has been rising almost nonstop since reaching a near-term low on Oct. 27. A Deutsche Bank study of the S&P 500’s performance going back to 1928 shows Oct. 27 has historically marked the end of autumn’s seasonal weakness and the start of a holiday rebound.

Investors are taking notice. A Deutsche Bank measure of equity exposure among discretionary investors rose to a slightly overweight territory last week after hovering below a neutral level for more than a month. That’s lifted the overall measure of equity positioning among rules-based and discretionary investors to a neutral level.

“For now, positive seasonality and short covering continues to support risk-on conditions, underpinned by the pullback in Treasury yields,” said Damanick Dantes, portfolio strategist at Global X. “Markets continue to position for the end of the Fed’s rate hike cycle.”

©2023 Bloomberg L.P.