Feb 16, 2024

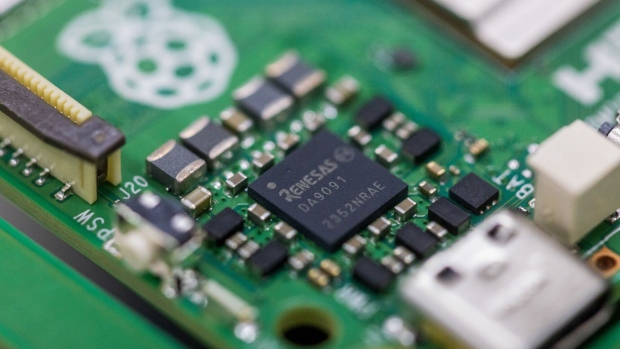

Japan Banks to Provide Loans For Renesas Purchase of Altium, Sources Say

, Bloomberg News

(Bloomberg) -- Mitsubishi UFJ Bank and other major Japanese banks are planning to finance Renesas Electronics Corp.’s acquisition of software company Altium Ltd., according to people familiar with the matter.

Mizuho Bank and Sumitomo Mitsui Trust Bank will also provide financing for the purchase of the Australian-listed firm, the people said, asking not to be identified because the matter is private. The three banks have already submitted a letter of commitment to Renesas promising to provide a total of 1 trillion yen ($6.7 billion) in loans to finance the transaction, the people said.

The loan will be denominated in yen and later syndicated, with Mitsubishi UFJ and Mizuho each contributing about 460 billion yen, while Sumitomo Mitsui Trust Bank will provide more than 70 billion yen. The loan is set to expire in one year, and Renesas will consider other forms of fundraising including switching to long-term borrowing after one year.

Renesas on Feb. 15 agreed to buy Altium for about A$9.1 billion ($5.9 billion). It plans to complete the acquisition during the second half of 2024. The deal would mark the biggest acquisition yet of an Australian-listed company by a Japanese buyer.

Representatives from Renesas, Mitsubishi UFJ, Mizuho and Sumitomo Mitsui Trust declined to comment.

Renesas, which has ties with Nissan Motor Co. and Honda Motor Co., has been acquisitive in the past. It acquired UK-based Dialog Semiconductor Plc for $6 billion in 2021 and earlier bought San Jose-based Integrated Device Technology Inc. to expand beyond the automotive sector into data centers and consumer devices.

(Updates with background on Renesas previous deals in last paragraph.)

©2024 Bloomberg L.P.