Oct 20, 2022

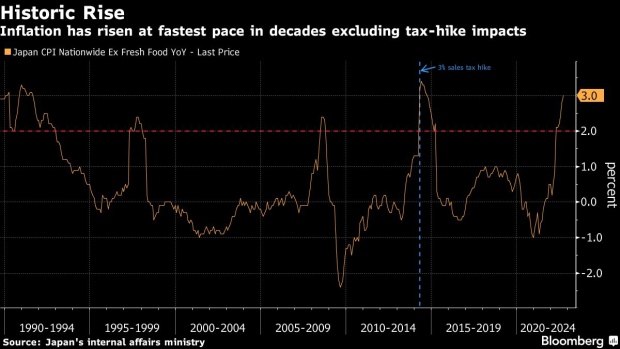

Japan Inflation Hits 3% for First Time Since 1991 Excluding Tax Hike Impacts

, Bloomberg News

(Bloomberg) -- Japan’s inflation hit 3% for the first time in over three decades excluding the impact of tax hikes, an acceleration that adds to the doubts over the need for continued central bank stimulus.

The rise in September’s consumer prices excluding fresh food from a year ago, matched analysts’ forecast. The inflation reading was the highest since 1991 outside a jump in 2014 when prices were impacted by an increase in the sales tax.

The price acceleration comes as global funds appear to have stepped up their bets against Bank of Japan policy once more. Ten-year swap rates are at a level that signal at least some traders are betting the central bank will be forced to capitulate on their policy of capping 10-year yields to help boost the economy.

Still, despite the market speculation and the extended stretch of price gains beyond its 2% goal, economists expect the BOJ to stick with its ultra-loose policy at a meeting next week, cementing its isolated position among global central banks and maintaining weakening pressure on the yen.

Governor Haruhiko Kuroda is likely to keep arguing that wages need to increase much more before the BOJ’s goal of stable inflation has been achieved. Kuroda has repeatedly argued that the current strength of price gains is based on cost-push factors such as energy imports that will dissipate in the coming year.

While energy remained the biggest contributor to price rises from a year earlier, gains in processed food and household durable goods were behind the further acceleration in inflation in September. That shows that inflation is spreading beyond the power sector.

“In October, inflation may reach 3.3% or 3.4% as many food prices are going up, mobile phone fees are giving a lift and service prices are rising,” said Mari Iwashita, chief market economist at Daiwa Securities Co. “The BOJ seems to focus on downside risks overseas to conclude that it will need to keep up monetary easing. It strikes me that they have already made the decision to maintain easing.”

The continued price rise has also hit Japanese households’ ability to spend, a development that’s been dragging on Prime Minister Fumio Kishida’s already sinking popularity.

What Bloomberg Economics Says...

“Looking ahead, we expect core inflation to peak at 3.1% in 4Q, before slowing to 2.8% in 1Q. A weaker yen will likely increase the cost of imports. Pushing the other way, nationwide travel subsidies that started Oct. 11 may shave as much as 0.25 percentage point from the core gauge.”

-- Yuki Masujima, economist

For the full report, click here

In October, the price of about 6,700 food items were raised, according to a Teikoku Databank survey. So far this fiscal year, the price tag on over 20,000 food items were lifted, which increased the costs borne by households by at least 70,000 yen ($466.16) per year, the report estimates.

Meanwhile paycheck growth continues to fall behind inflation, with the latest real wages data showing a 1.7% decline compared to the previous year.

To counter the impact, Kishida is compiling an additional economic stimulus package by the end of this month, including support for households hit by accelerating inflation. Whether or not he succeeds in addressing public discontent over inflation could be key for Kishida’s longevity in the top job.

The prime minister also said he’d launch relief measures to counter rising electricity bills in January next year or later. He said gasoline subsidies will also be maintained after January, and relief on natural gas bills will be introduced as well. The strong September inflation reading may pressure Kishida to go big on this month’s stimulus package.

The BOJ will reportedly raise the core consumer inflation forecast for the current year to the upper half of the 2% range. Still, Governor Kuroda continues to expect that price growth will weaken below 2% next fiscal year and onward.

The yen fell past a closely watched 150 per dollar level on Thursday, keeping investors on high alert for possible intervention to support the currency.

Japan’s chief currency official Masato Kanda told reporters that excessive foreign exchange moves are becoming even more intolerable, and that resources for intervention are limitless.

(Updates with more market details)

©2022 Bloomberg L.P.