Mar 10, 2024

Japan’s Economy Avoids Recession One Week Before BOJ Meeting

, Bloomberg News

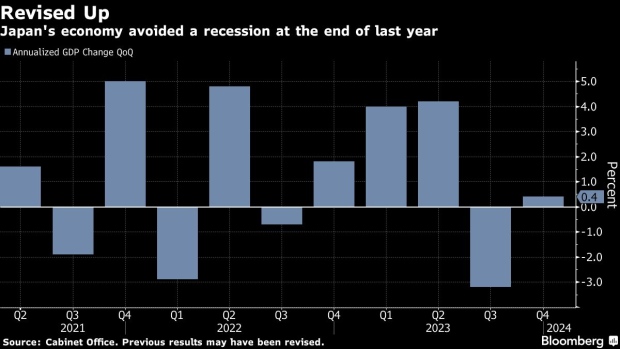

(Bloomberg) -- Japan’s economy avoided falling into a recession at the end of last year, helped by robust spending by businesses, an outcome that improves the optics for the central bank as it mulls the timing of its first interest rate hike since 2007.

Gross domestic product expanded at an annualized pace of 0.4% in the final three months of last year, the Cabinet Office said Monday, reversing a 0.4% retreat initially reported. While the upwardly revised data point to more resilience in the economy than initially thought ahead of next week’s Bank of Japan policy meeting, the figures also showed that consumers are continuing to spend less in real terms as inflation weighs.

Economists had forecast the updated figures would show growth of 1.1%.

The yen and bond yields rose on notions that the BOJ is edging closer to ending the world’s last negative interest rate, with market expectations ramping up for a move as early as this month.

Monday’s data support the BOJ’s view that the economy continues to recover moderately with companies optimistic enough to bump up investment and workers’ pay. Corporate capital investment was revised to a 2% advance, powering growth last quarter. Consumer spending, on the other hand, was revised to show a slightly deeper decline at 0.3%.

The weak spending data probably won’t deter the BOJ from making a move, according to Takashi Miwa, senior economist at Nomura Securities Co.

“The BOJ’s outlook reports in October and January suggested that the bank wasn’t to too concerned about a decline in spending,” Miwa said. “The bank has consistently assessed that the virtuous cycle between wages and price is strengthening,” and the GDP data probably won’t change that view.

Nobuyasu Atago, chief economist at Rakuten Securities Economic Research Institute, said the figures were weaker than expected, with domestic demand hit by rising prices. Still, he expects the BOJ to make a policy move this month.

“If they don’t move in March even with strong results from the wage talks, that could send the yen lower and risk damaging consumers further with higher import costs,” Atago said. “It’s a big dilemma for the BOJ to wait until April.”

A majority of economists expects the BOJ to scrap the negative interest rate in March or April. Encouraging signs of wage growth this year have increased bets on the rate hike coming on March 19, when the bank concludes its next policy meeting.

Inflation has continued to outpace wage gains this year, putting a burden on household budgets and crimping outlays. Early data indicate the weakness is carrying over into 2024. Household spending declined by 6.3% in January from a year earlier, the biggest drop since February of 2021.

The yen initially extended gains after the data before retracing that move, while volatile overnight swaps that signal rate expectations showed a 65% change of the BOJ hiking in March, also largely unmoved. Yields on benchmark government bonds continued to rise.

The focus is now on annual pay negotiations between companies and labor unions, which will culminate with results from the biggest union group, Rengo, on March 15, the last business day before the BOJ starts its two-day gathering. The constituents of the union federation have demanded on average the biggest pay hike since 1993, at 5.85%, compared with demands for a 4.49% increase a year ago.

BOJ Governor Kazuo Ueda has repeatedly cited the importance of the wage negotiations as a catalyst for a virtuous wage-price cycle that would signal its price goal is achieved, and enable the bank to normalize its policy settings. Board member Hajime Takata said the price target is “finally” coming into sight, boosting market bets on a March move.

What Bloomberg Economics Says...

“All in all, the GDP report depicts an economy that’s probably not strong enough to convince the Bank of Japan that it’s safe to end its negative interest rate policy at next week’s meeting.”

— Taro Kimura, economist

For the full report, click here.

Prime Minister Fumio Kishida is monitoring trends in consumption and wages as a key to judging whether the country has finally overcome deflation. The premier reportedly plans to meet with business leaders and union leaders this week for a final push.

The approval rating for Kishida’s government fell 4.4 percentage points to a fresh low of 20.1% in a Kyodo News survey published Sunday.

The BOJ’s window for normalizing policy may not stay open for too much longer, Atago said. “The longer they wait, the harder it will become for them to end the negative rate.”

--With assistance from Yumi Teso.

(Adds comments from economists)

©2024 Bloomberg L.P.